来源:雪球App,作者: 王冠亚,(https://xueqiu.com/4525540121/301452554)

巴菲特致股东的信原文精读Day437:

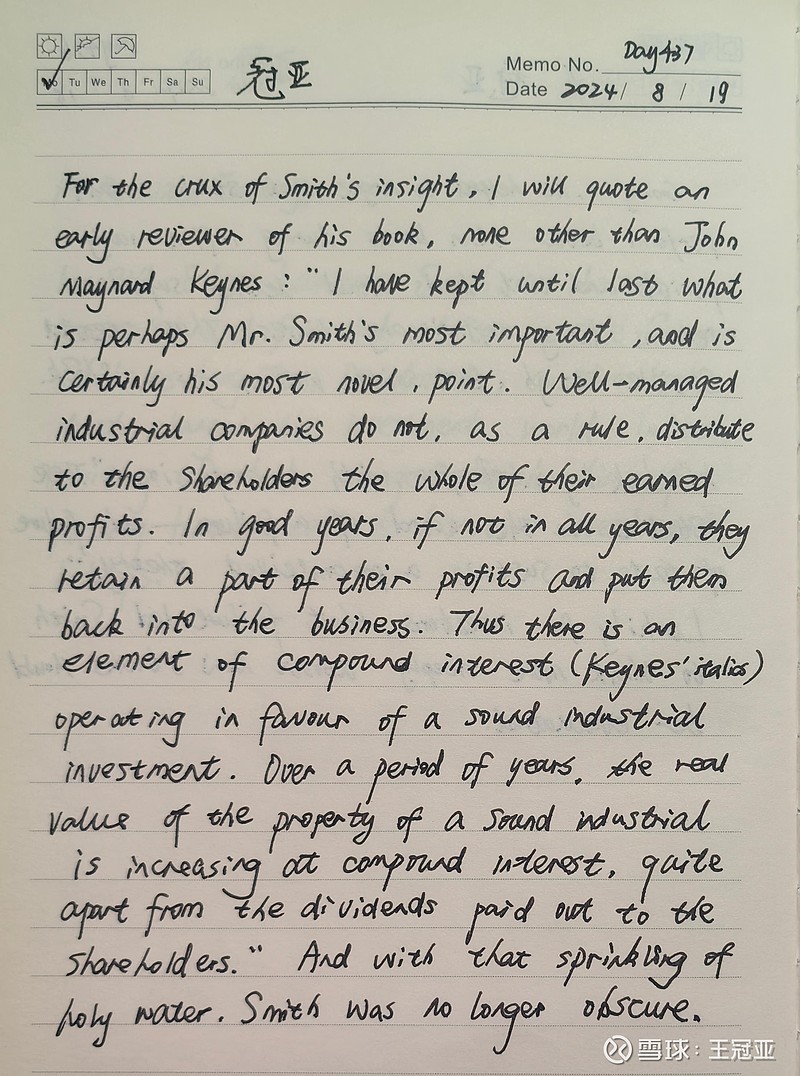

原文:For the crux of Smith’s insight, I will quote an early reviewer of his book, none other than John Maynard Keynes: “I have kept until last what is perhaps Mr. Smith’s most important, and is certainly his most novel, point. Well-managed industrial companies do not, as a rule, distribute to the shareholders the whole of their earned profits. In good years, if not in all years, they retain a part of their profits and put them back into the business. Thus there is an element of compound interest (Keynes’ italics) operating in favour of a sound industrial investment. Over a period of years, the real value of the property of a sound industrial is increasing at compound interest, quite apart from the dividends paid out to the shareholders.” And with that sprinkling of holy water, Smith was no longer obscure.(2019)

释义:1.“crux”意为“关键”;“none other than”意为“正是”;“novel”意为“新颖的”;

2.“italics”意为“斜体字”;“a sound”意为“坚实的”;

3.“apart from”意为“除了……以外”;

4.“sprinkling”意为“洒下”;“holy”意为“神圣的”。

精译:对于史密斯的核心观点,我将引用早期一位读者对这本书的评价,此人正是约翰·梅纳德·凯恩斯,他说:“我一直留到最后才说,这可能是史密斯先生最重要也最新颖的观点。通常而言,管理有方的产业公司不会将其全部盈利分配给股东。在好的年份(如果不是在所有年份的话),他们会保留一部分利润并将其重新投入企业。因此,有一种复利的因素(斜体是凯恩斯加的)有利于夯实产业投资。在一段时间内,除了向股东支付的股息以外,产业公司财产的实际价值以复利稳定增长。随着圣水的洒下,史密斯不再默默无闻。(2019年)

心得:凯恩斯被誉为现代“宏观经济学之父”,他在剑桥大学担任研究员期间,曾管理剑桥大学国王学院切斯特基金。1928年~1945年,基金年化回报率约13.06%,而同期英国市场年化回报率仅为-0.11%,美国大盘股年化回报率为1.56%。凯恩斯的投资穿越了经济大萧条及二战,其投资水平堪称“股神级”。有一种观点认为,凯恩斯正是因为读到了史密斯《普通股的长期投资》而萌发了投资股票的念头。史密斯的理论支持着凯恩斯的投资实践,而凯恩斯的褒奖则推动着史密斯从籍籍无名走向家喻户晓,两人也称得上是“相互成就”的典范。

手抄:

朗读:大家请自由发挥,哈哈哈!大家的手抄原文,也可以在评论区上传打卡。