You sign up for TradeSanta thinking it’s just another bot—but within minutes you’re building grid or DCA bots, tweaking indicators, and actually launching live bots. That onboarding thrill hits fast. One reviewer said they had two bots making profit within five minutes of sign-up—even with zero experience. That’s the kind of momentum that hooks you fast.

What TradeSanta Is and Isn’t

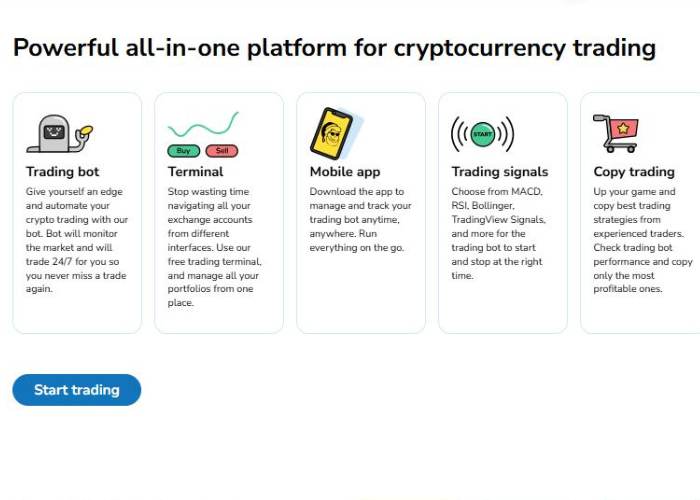

TradeSanta bills itself as a cloud-based crypto bot platform—supporting major exchanges like Binance, Coinbase Pro, Huobi, OKX, HitBTC, Upbit. You build bots using templates (Grid, DCA, Futures) or set parameters manually. Indicators like RSI, MACD, Bollinger Bands, trailing take profit, stop loss are all configurable in a no-code interface. It’s not “AI‑driven” in the machine-learning sense, more like smart rule automation, but it lives up to its “automated crypto trading” billing nicely.

How My Testing Went… in Jumps

Morning 1: Built a grid bot on ETH/BTC pair after reading a tutorial. Fired it in demo mode first. Felt like a pro.

Day 2: Promoted the rule live. First few trades got stopped out. Took that as market teaching me a lesson.

Day 3: Tried the DCA futures bot—surprisingly a small profit came through overnight. Felt redeeming.

Day 4: I tested Copy Trading: picked a shared strategy from community marketplace and let it run. Feedback came in Telegram—alerts and status. Human touch.

Throughout: Hit a snag with a stale grid parameter—reached out to “Santa’s Helpers.” Support answered quickly. Friendlier than expected.

What You Actually Get

| Feature | Description | My Impression |

| Grid Bot | Buys and sells within price zones | Simple, effective in range-bound markets |

| DCA Bot | Averages buy entries to reduce risk | Solid for dips—but mind the entry cadence |

| Futures Bot | Enables leveraged automated execution | Adds power—but also risk (start small) |

| Copy Trading | Mirror seasoned user strategies from Marketplace | Good learning tool and shortcut to deploy tested logic |

| Stop Loss / Trailing | Manage risk automatically | Key safeguard that mitigated early losses |

| Demo mode | Virtual testing without real funds | Useful to bootstrap learning—but misses slippage realism |

| Exchange Support | Binance, Coinbase Pro, Huobi, OKX, HitBTC, Upbit | Covers major markets though still limited to ~8 |

Pros and Cons—In Plain Truth

What’s Good:

- Sets up bots in minutes—templates cut the confusion.Demo mode helps you test before risking.Supports futures bots on higher plans.Copy trading and marketplace ease entry.Responsive support, solid community feedback.Affordable plans starting ~$14–20/month, unlimited bots on Maximum plan.

What Falls Short:

- Only basic indicators; lacks AI optimization tools.Demo mode doesn’t simulate slippage or fees realistically.Free trial just three days—not enough time to explore all bots.System lag reported during elevated volume can cost mis-executions.No built-in portfolio analysis or risk scoring like some rivals.

The Emotional Rollercoaster

Day one: pumped, building a grid bot. Felt the thrill.

Day two: braced for losses; stop‑loss hit fast. That gut-punch of mistakes learned the hard way.

Day three: small profit from DCA rule. That gave hope—a reminder automation can work.

Mixed in: slight frustration when alerts missed a fill because of API latency. It reminded me: bots aren’t magic. They’re tools—you still need verification.

Community narrative matches mine—users say “won’t make you rich overnight” but for ~$20/month it’s worth the setup.

Pricing Snapshot

| Plan | Monthly Cost | Features |

| Basic | Free or ~$0 | Demo bots, limited active bot count, delayed data |

| Advanced | ~$20/mo | Live bots, up to ~50 bots, basic indicators |

| Maximum | ~$70/mo | Unlimited bots, copy-trade, full futures support |

Note: TradeSanta doesn’t charge maker/taker fees themselves, but exchange fees still apply. There’s no free forever tier beyond demo.

Who Should Use It?

- Traders new to automation who want simple no-code setupPeople who prefer drag‑and‑drop bots over scriptingBeginners curious about grid, DCA, futures botsThose who want minimal maintenance after setup

Not ideal for those expecting full AI-driven optimization or portfolio-level oversight—or high-frequency execution traders needing ultra-low latency.

Suggestions for Improvement

- Extend free trial to 7–14 days so newbies can explore features slower.Add real market slippage simulation to demo modeExpand supported exchanges beyond eight major onesOffer more advanced indicators and AI-based strategy toolsBetter transparency on missed fills or system capacity alerts

Final Take (My Personal Opinion)

TradeSanta is what I’d call a “crypto bot engine-lite”: easy to spin up bots, helpful marketplace, solid support—but no fancy AI modeling or predictive analytics. It doesn’t guarantee profit, but it automates strategies reliably if you know what you’re doing.

If you’re getting started, the intuitive interface and low cost help you test the waters safely. If you’re more advanced, it gives you flexible bots and futures options—but eventually you’ll outgrow its limited indicators and manual-heavy design.

Try the demo, run a couple of bots with small capital, and see if the performance feels reasonable. If yes, scale slowly. If it clicks—great. If not, don’t blame the tool for bad rules.

Need help designing a grid bot setup or risk-managed DCA rule? I’m happy to walk through real parameter examples or rule ideas.