来源:雪球App,作者: Bear_Prince,(https://xueqiu.com/8515806869/301346514)

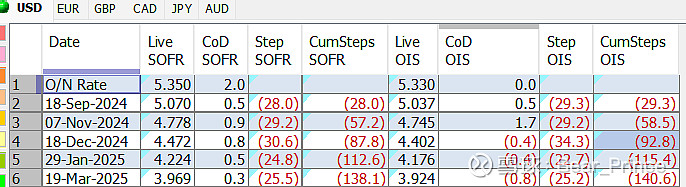

当前front end prices大约 92bps cut by year end. Sept FOMC大约29bps, 然后Nov 29bps.

这周一些数据和event:

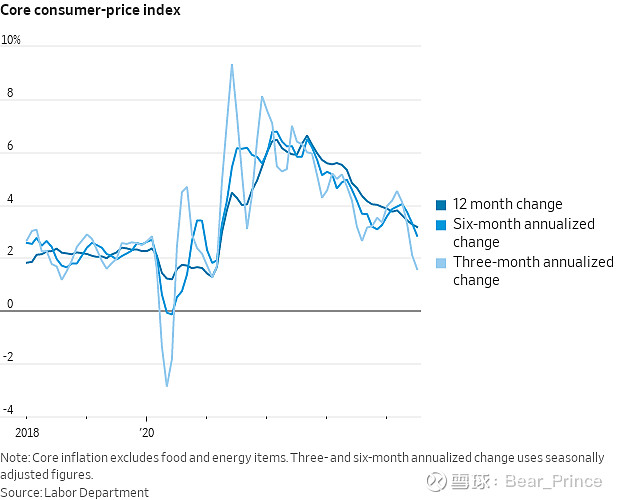

1. Continuing down trend of inflation data PPI and CPI both came in weaker. Fed一些比较顽固的member(Bostic for example)也终于得到他们想要的"further evidence", rate cut in Sept 基本warranted。

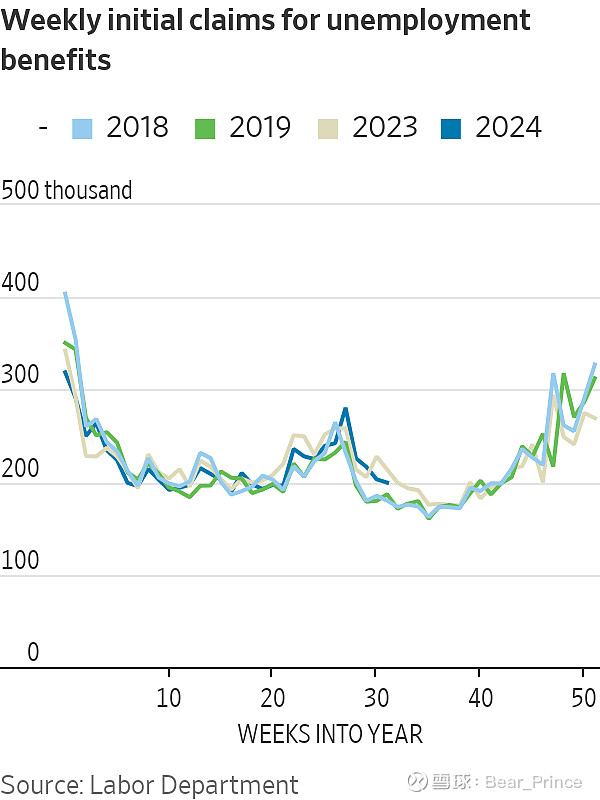

2. Weekly jobless claims came in below est again. 这作者认为further negate July NFP的results。尤其从trend来看(seasonal adjusted),weekly claims slightly run above seasonal trend,没有完全出现NFP indicated失去控制的情况:

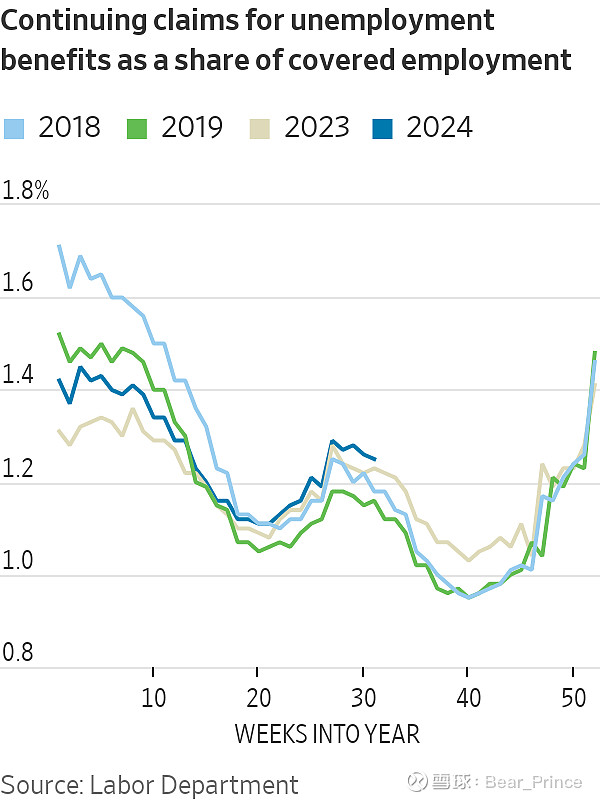

Continuous claims are higher than seasonal trend which is in line with a loosening labor market. 但看起来并没有那么糟糕(at least for now):

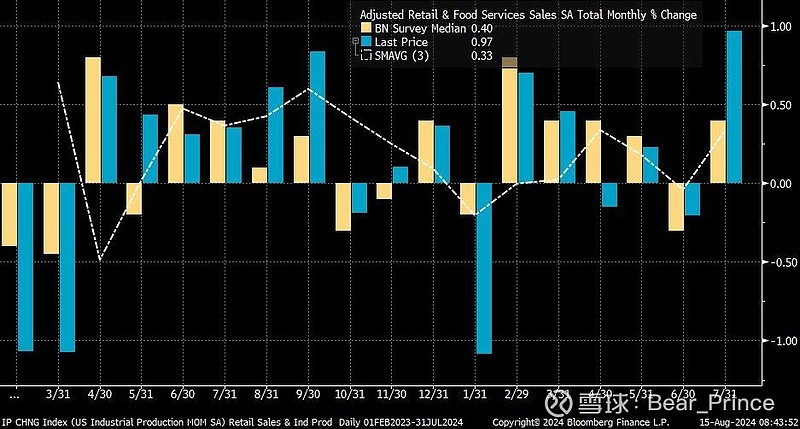

3. Headline retail sales came in +1.0% MoM in July vs 0.4% est. Core beats est as well. It was biggest upside surprise since Jan 2023.

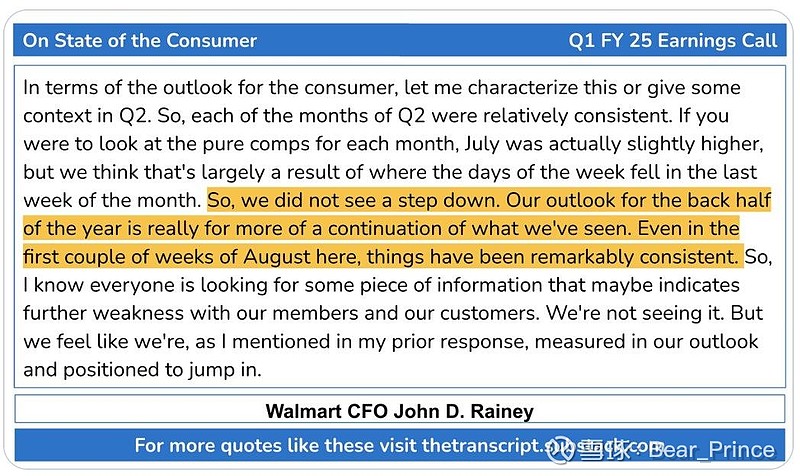

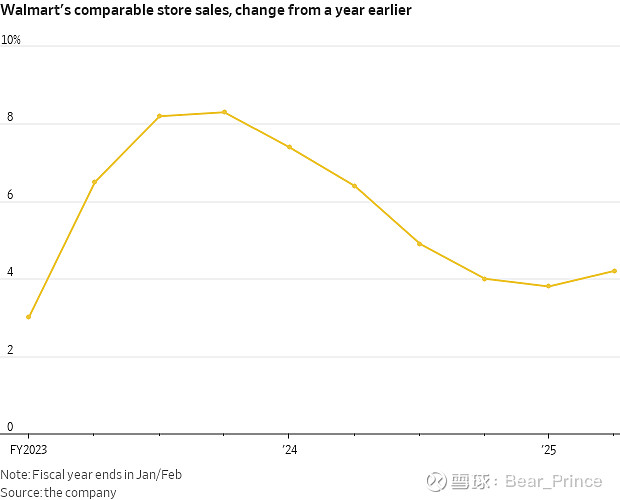

4. WMT earning. July NFP created fear on broad labor market problem especially 2/3 of household survey job loss from temp workers. Where do these temp workers and their family buy grocery(certainly not wholefoods)? 在earning里明确提到了consumer还是非常resilient,another sign July NFP was one off noise.

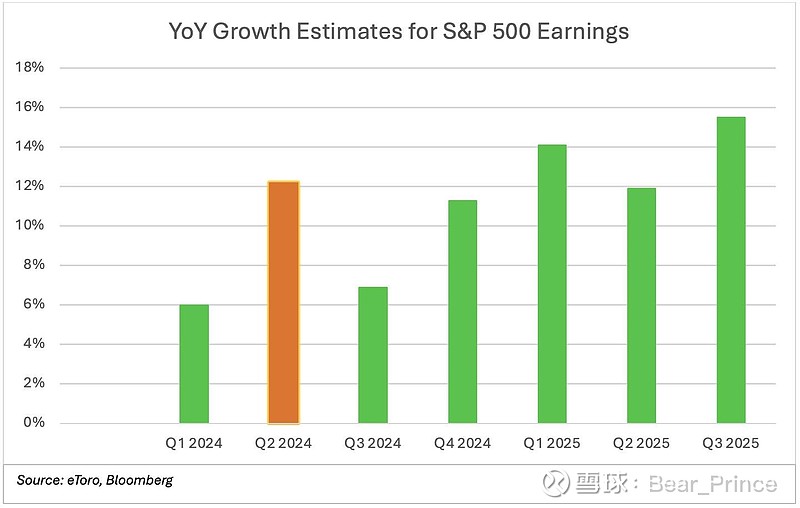

5. More than 80% S&P 500 companies beat earning with Q4 to CY2025 guiding double digit earning growth.

结论

September cut is warranted by new inflation data, 然而,US consumer还是非常resilient(for now), 而近期的Weekly claims normalized vs end July spikes added confidence on weather impact was temporary. 在研究了过去weather impact on NFP的一些case后,作者认为下一个NFP会比较强劲with minimum headline jobs beat by large。那么根据当前pricing, front end is still too rich。作者认为duration down side into Jackson hole, NFP, Sept FOMC非常attractive。

当然作者认为Fed should have started cut in July(warranted by labor market and inflation data)。但我也能理解他们想要再多等一两个set的谨慎想法。只是想在他们把自己逼在了一个非常tricky的角落,move 25bps first while market is pricing 90bps by year end is a material repricing. 倘若他们7月cut 25bps, 9月可以轻松25bps again, then they can wait to see more data。但如果他们9月,按照当前的数据(尤其when better NFP comes in), 又会spook market(although I think fair price is 50bps cut by Sept). 所以从作者的角度Fed has been slightly behind curve, when they move 25bps in Sept FOMC, they are a bit more behind curve. Any weak data post Fed's Sept 25bps move, will likely raise recession fear again. I will potentially revisit TLT upside after Sept FOMC.

(Interestingly during peak panic this month, Wharton Professor Jeremy Siegel went on TV calling 75bps emergency cut and another 75bps cut for Sept meeting, Yesterday he denied calling recession on TV again)

作者今天在Umich consumer beat expectation(first time in 5month) 后,认为另一个确认US consumer remain strong的证据,close所有TLT upside, 买入:

.$美国国债20+年ETF-iShares(TLT)$ 09/06 96.5 put paying $0.94 covering NFP

.$美国国债20+年ETF-iShares(TLT)$ 09/20 96.0 put paying $0.75 covering Sept FOMC

Catalysts Jackson Hole, auction supply, month end ex-dividend, NFP and FOMC

1st PT 94, 2nd PT 91.5, if moves quickly ITM, consider selling 92 puts to take profit and carry through catalysts.

仓位无法及时更新,not financial advice