来源:雪球App,作者: 王冠亚,(https://xueqiu.com/4525540121/299874633)

巴菲特致股东的信原文精读Day423:

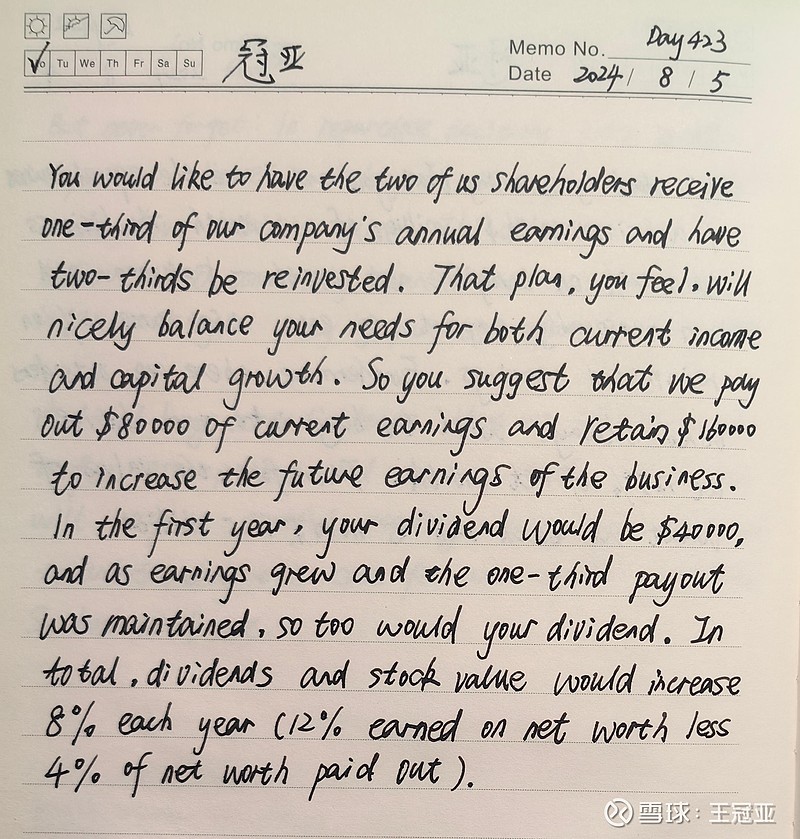

原文:You would like to have the two of us shareholders receive one-third of our company’s annual earnings and have two-thirds be reinvested. That plan, you feel, will nicely balance your needs for both current income and capital growth. So you suggest that we pay out $80,000 of current earnings and retain $160,000 to increase the future earnings of the business. In the first year, your dividend would be $40,000, and as earnings grew and the one-third payout was maintained, so too would your dividend. In total, dividends and stock value would increase 8% each year (12% earned on net worth less 4% of net worth paid out).(2012)

释义:1.“earnings”意为“利润”;

2.“net worth”意为“净值”。

精译:你希望我们公司年收益的三分之一用于分红,三分之二用于再投资。你认为,这一计划将很好地平衡你对当前收入和资本增长的需求。所以你建议我们支付8万美元的当前收益,并保留16万美元以增加企业的未来收益。在第一年,你收到的分红将是4万美元,随着净利润的增长以及维持三分之一的分红,你的分红也会保持增长。总的来说,股息和股票价值每年将增长8%(净值增长12%,减去相当于净值4%的分红)。(2012年)

心得:今天的计算依然是小学数学题:公司净值200万美元,RoE为12%,第一年盈利24万美元,其中8万美元用于分红,16万美元用于再投资。公司净值每年增长12%,其中有4%都被用于分红,实际上股票价值每年增长8%。

手抄:

朗读:大家请自由发挥,哈哈哈!大家的手抄原文,也可以在评论区上传打卡。