来源:雪球App,作者: 王冠亚,(https://xueqiu.com/4525540121/298549281)

巴菲特致股东的信原文精读Day411:

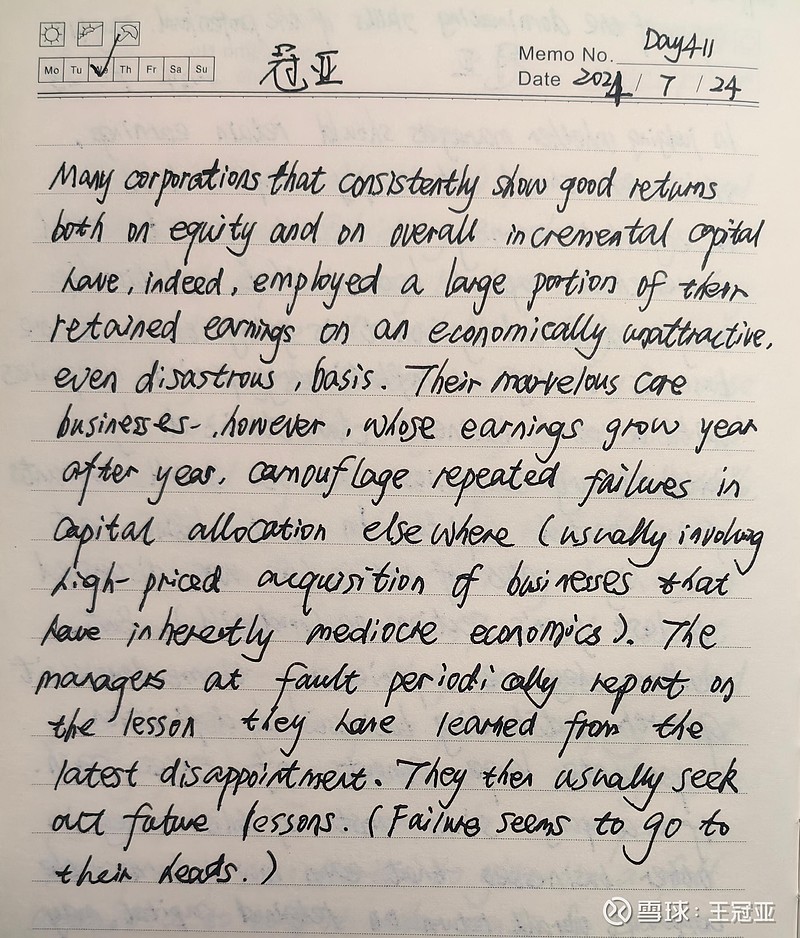

原文:Many corporations that consistently show good returns both on equity and on overall incremental capital have, indeed, employed a large portion of their retained earnings on an economically unattractive, even disastrous, basis. Their marvelous core businesses, however, whose earnings grow year after year, camouflage repeated failures in capital allocation elsewhere (usually involving high-priced acquisitions of businesses that have inherently mediocre economics). The managers at fault periodically report on the lessons they have learned from the latest disappointment. They then usually seek out future lessons. (Failure seems to go to their heads.)(1984)

释义:1.“disastrous”意为“极糟糕的”;

2.“marvelous”意为“了不起的”;“camouflage”意为“掩饰”、“伪装”;“inherently”意为“固有的”;“mediocre”意为“平庸的”;

3.“go to their heads”意为“冲昏头脑”。

精译:事实上,很多公司的净资产收益率很高,资本增量的整体收益率也表现出色,但它们的大部分留存收益,实际上投入到了那些缺乏吸引力甚至灾难性的业务上。然而,他们出色的核心业务,其收益年复一年地增长,掩盖了在其他地方资本配置的反复失败(通常涉及对平庸企业的高价收购)。犯错的经理人会定期报告他们从最近令人失望的投资中吸取的教训。然后,他们未来还会一而再、再而三地犯错。(失败似乎让他们很上头。)(1984年)

心得:巴菲特说的这段话,从中可以看到很多企业的影子。比如说,贵州茅台的净资产收益率就很高,虽然它的留存收益使用效率较低,但出色的核心业务掩盖了这一瑕疵。茅台还算好的,毕竟它的冗余资金只是拿去存银行,并没有四处高价收购垃圾业务。最坏的情况是,主营业务还不错,却拿着现金去收购一堆烂业务。就像有个段子讲的,原来主营业务的贡献率是100%,自从搞了多元化,现在主营业务的贡献率变成了150%。

手抄:

朗读:大家请自由发挥,哈哈哈!大家的手抄原文,也可以在评论区上传打卡。