TMTPOST -- Lenovo’s tariff concerns have largely subsided, clearing the way for the PC maker to focus on AI-driven expansion, according to Chief Executive Yang Yuanqing.

“The tariff impact is very limited now,” Yang said Thursday, noting the company has handled past challenges “very smoothly” thanks to its global manufacturing network.

Yang had earlier cited uncertainty as the biggest risk to Lenovo in the current geopolitical climate, but now sees a more favorable environment for growth.

Lenovo’s revenue for the quarter ended June 30 jumped 22% from a year earlier to $18.8 billion, beating analysts’ estimates of $17.4 billion, LSEG data showed.

Yang credited the strong results to robust AI-driven demand across Lenovo’s three core business units, all of which recorded double-digit growth in the first quarter.

Although Chinese exports to the U.S., including PCs, remain subject to a 30% tariff despite the trade truce, Yang noted that the U.S. contributes less than 20% of Lenovo’s total revenue. He added that the company’s diversified global manufacturing network has largely insulated it from tariff impacts.

Net profit attributable to shareholders more than doubled to $505 million, far above the market consensus of $307.7 million.

Yang said that the company’s network of over 30 factories in more than 10 countries provides “a lot of flexibility and resilience.” He forecast global PC shipments would grow by a mid- to high-single-digit percentage in the fiscal year ending next March, with Lenovo set to outperform the market.

Lenovo’s PC shipments grew 15% in the quarter, outpacing rivals HP and Dell, while the broader market expanded 8.4%—its fastest growth since 2022—driven by a replacement cycle ahead of Windows 10’s end-of-support and front-loaded purchases, according to Counterpoint Research.

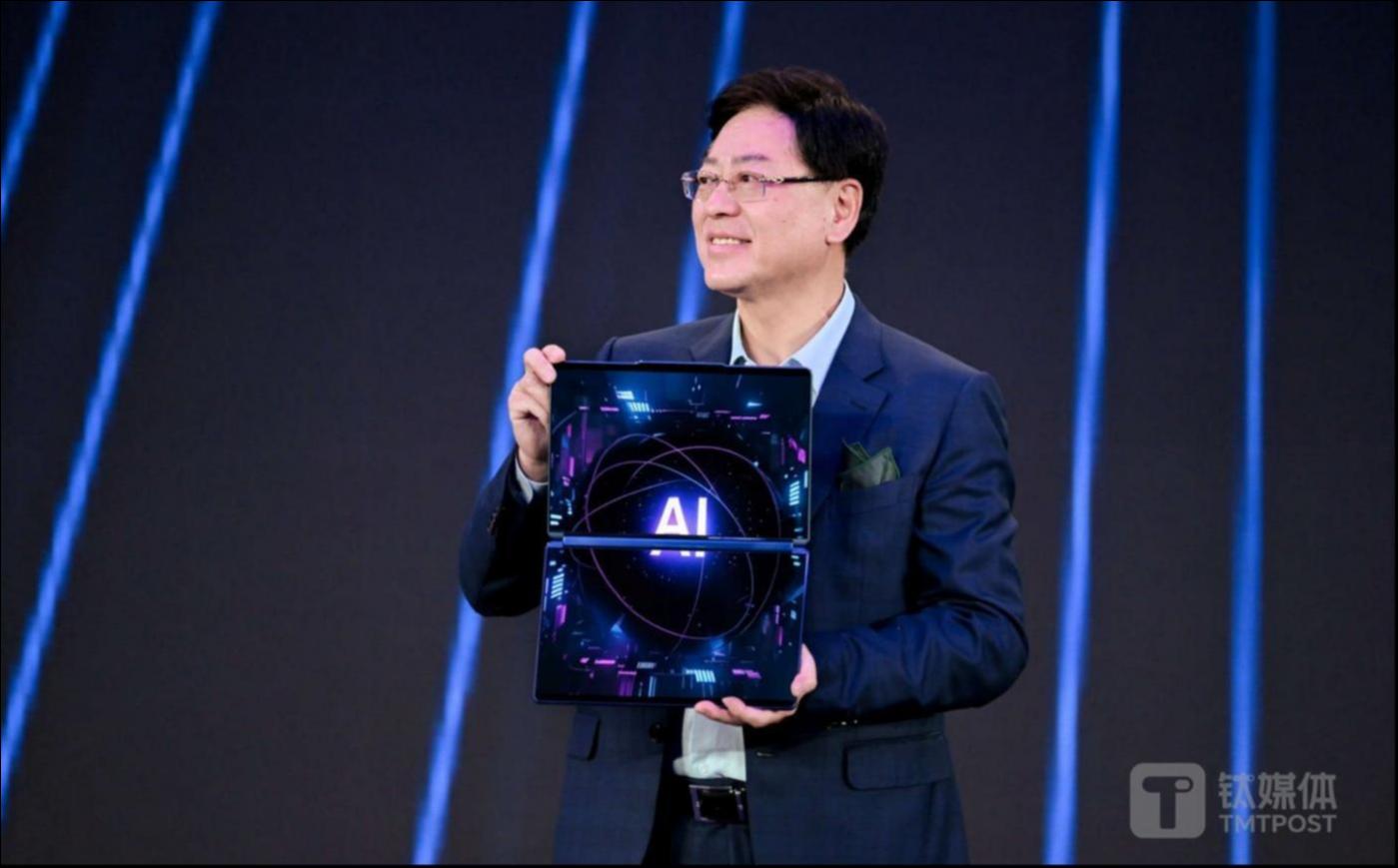

Like competitors, Lenovo is promoting AI PCs equipped with advanced hardware to handle tasks such as real-time transcription and image generation.

Bloomberg Intelligence noted that Lenovo’s 22% sales growth in fiscal Q1, beating estimates by 7%, suggests its cloud segment—up 36%—could become a bigger growth driver amid strong AI server demand. However, analysts Steven Tseng and Sean Chen cautioned that the unit’s widening losses show further investment may be needed to meet demand and frequent system upgrades, potentially weighing on margins.

Looking ahead, U.S. tariffs could pose risks. Counterpoint Senior Analyst Minsoo Kang said PC shipments may weaken year-on-year in the second half of 2025 due to “U.S. tariff-related uncertainty.” President Donald Trump has announced tariffs on certain imports and plans for a 100% levy on chips, raising industry concerns.

Beyond PCs, Lenovo’s infrastructure solutions group—which sells servers and storage—recorded a 36% revenue jump to $4.3 billion, buoyed by AI infrastructure demand in Asia. The unit, however, posted a larger $85.5 million loss in the June quarter.

AI PCs made up over 30% of Lenovo’s total PC shipments during the quarter, while its AI server business surged 150% on strong domestic demand. “We see a strong pipeline in AI servers,” Yang said.

Amid U.S.-China tensions over semiconductors—and following Washington’s approval for Nvidia to resume sales of H20 chips to China—Beijing has urged major internet companies to consider domestic alternatives. Yang said China’s AI infrastructure is expanding faster than anywhere else and emphasized Lenovo’s investments in diversifying supply chains.

“Beyond selling global products, we’ve invested heavily to develop top-quality local components to meet different customer needs,” he said.

Lenovo’s shares slipped over 3% in early Thursday trading, contrasting with a 0.4% gain in the Hang Seng Index, though the stock is still up 15% in the past three months, outperforming the broader market.

更多精彩内容,关注钛媒体微信号(ID:taimeiti),或者下载钛媒体App