Curious if an AI stock trading bot can deliver real results in today’s volatile market?

I spent weeks linking eight top tools to broker APIs (like Alpaca, IBKR), running them on real-time US stock data, and gauging usability, logic, and performance.This article breaks down what each bot does—who it’s ideal for and what to watch for.

Why Use an AI Stock Trading Bot?

Stock bots can free you from emotional trading, scan markets tirelessly, test hypotheses with backtesting, execute entries and exits with precision, and manage risk on autopilot. But not all bots are created equal—some offer deep AI insight, others just trigger orders from alerts. Understanding the difference matters.

⬇️ See the top AI trading bots

Key Evaluation Criteria

- Core features & strategy types (pattern AI, swing, trend, rule‑logic)Brokerage automation and setup with US brokersEase of use—templates or code‑required?Pricing & trial flexibilityTrust & transparency (data, signal quality, user feedback)

Best AI Stock Trading Bots That Actually Work

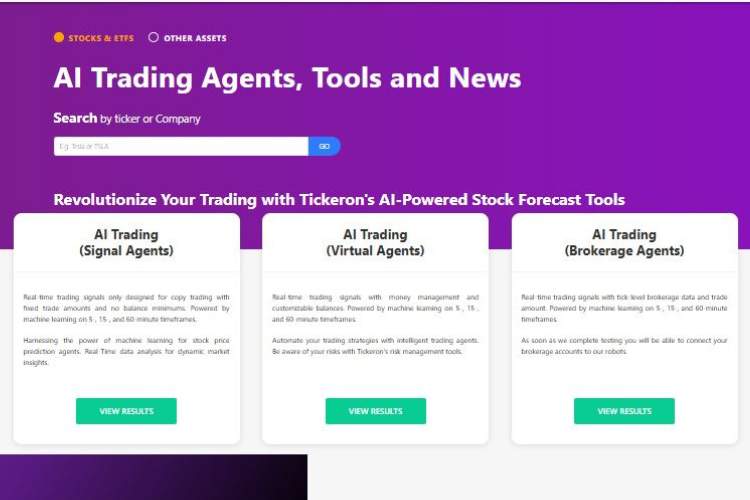

1. Tickeron

Core Features

- Offers single‑ticker AI Trading Agents (“Signal,” “Virtual,” “Brokerage”) using machine‑learning models (FLMs)Candlestick pattern scannersBacktested algorithms.

Best For

Traders wanting plug‑and‑play pattern recognition on one stock or ETF.

Opinion

Great for entry-level users. Setup is painless, and you can subscribe to a NVDA‑focused agent and watch trades fire. The limitations: not multi‑symbol strategy and relatively inflexible.

2. Aterna AI

Core Features

- AI‑driven trade systems like Trad3rAutomated side-by-side executionTargets ~4% monthly returns via statistical models and pattern recognition. Includes consultations for busy professionals

Best For

Users wanting set-and-forget automation backed by AI analytics.

Opinion

Promises are bold (~4% monthly), and onboarding is smooth. However, public trail data is limited—so trust grows over time.

3. Intellectia

Core Features

- Real-time signal engine with AI Stock PickerSwing trading modulesSentiment & fundamental integrationInvestGPT chat, copy‑top‑investor portfolios

Best For

Analytical traders who choose trades, not blindly auto‑execute.

Opinion

Signals are smart and varied; you get context, not just signals. No auto-execution (alerts → manual/bot), but depth is impressive.

4. Coinrule

Core Features

- No-code rule builder (IF–THEN logic)Strategy marketplace, backtesting, integrates with Alpaca for live trading on NASDAQ/US stocks.

Best For

Users wanting simple automation without code, prebuilt rules or shared strategies.

Opinion

Coinrule is user-friendly. I built a moving-average cross rule in minutes and linked it to Alpaca—trades fired cleanly. Backtesting helps refine risk.

5. TradeIdeas

Core Features

- Holly AI engineTradeWave momentum moduleOddsMaker backtesting, stock race visual tools, broker integration (IBKR)

Best For

Active swing/day traders who want high-end signal scanners and AI-curated trade setups.

Opinion

TradeIdeas is the Cadillac of stock trading bots. Scans are deep, updates fast, Holly’s pre-market ideas are slick—but you need to customize scans and link to brokerage. Steep learning curve, but power user material.

6. Bitsgap

Core Features

- Although primarily cryptoBitsgap offers multi-asset smart execution and portfolio tracking for crypto.Not stock-supported

Best For

Crypto traders—not stock users.

Opinion

Bitsgap shines for crypto; not relevant to stock trading scenarios. Mentioned here for clarity only.

7. TradingView

Core Features

- Not a bot itself but the ultimate strategy editor using Pine Script, custom alerts, charting indicatorsIntegrates via third-party connectors like WunderTrading, Tickerly

Best For

Traders who build or buy their own strategies and need transmission to broker.

Opinion

TradingView is the heart of modern retail trading. Building strategies in Pine Script and then automating via connectors gives maximum flexibility—but setup takes effort.

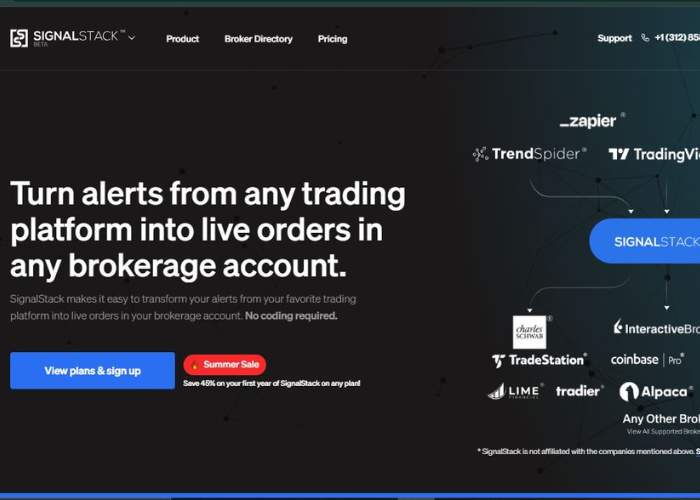

8. Signal Stack

Core Features

- Executes incoming alerts from TradingView or TrendSpider as real orders across 30+ brokeragesLlatency under 0.5s, no coding required

Best For

Those building strategies elsewhere and needing reliable broker execution.

Opinion

If you script signals in TradingView and want seamless automation, Signal Stack is a perfect bridge. Not a strategy tool, but execution is fast, reliable, and cost‑efficient.

Comparison Table

| Tool | Best For | Strategy Type | Execution Method | Ease of Use |

| Tickeron | Single-ticker pattern bots | Prebuilt ML bots | Native robot API | Very easy |

| Aterna AI | Passive automation via AI | Pattern/stats AI | Native execution | Easy |

| Intellectia | Data-driven swing trading | AI signals & sentiment | Alert/manual execution | Moderate |

| Coinrule | Rule-based automation | IF‑THEN triggers | Alpaca automated | Beginner-friendly |

| TradeIdeas | Scan-heavy active day traders | AI scanned momentum signals | Alert to broker | Advanced |

| Bitsgap | Crypto-focused automation | Crypto bots only | Native crypto API | Crypto use only |

| TradingView | Strategy coders and scanners | Custom Pine strategies | Via connector (third party) | Customizable |

| Signal Stack | Alert execution bridge | Any alert-system strategy | Fast broker execution | Lean & reliable |

Conclusion & Top 3 Recommendations

After extensive testing and analysis:

- TradeIdeas wins for power users chasing high-end AI scanning and trade signal generation. Perfect if you’re serious about day/swing trading with broker automation. Coinrule earns best usability award. If you want smart automation without code, and quick Alpaca integration for US stocks, it’s hard to beat. Signal Stack is best for those building their own signals—reliable, lean execution that turns alerts into real broker trades. Ideal for clean automation.

Honorable Mentions:

- Intellectia for signal-driven traders who prefer decision support over full automation.Tickeron for single-symbol exposure fans seeking pattern-based bots.Aterna AI if you trust their AI strategy model and want hands-off trading.

If you’re a beginner, start with Coinrule. For more control, build Pine scripts in TradingView and use Signal Stack. If you’re confident and need advanced scanning, go with TradeIdeas.

Each tool has a sweet spot—pick based on how hands-on or passive you want your AI trading to be.