来源:雪球App,作者: 王冠亚,(https://xueqiu.com/4525540121/297412281)

巴菲特致股东的信原文精读Day401:

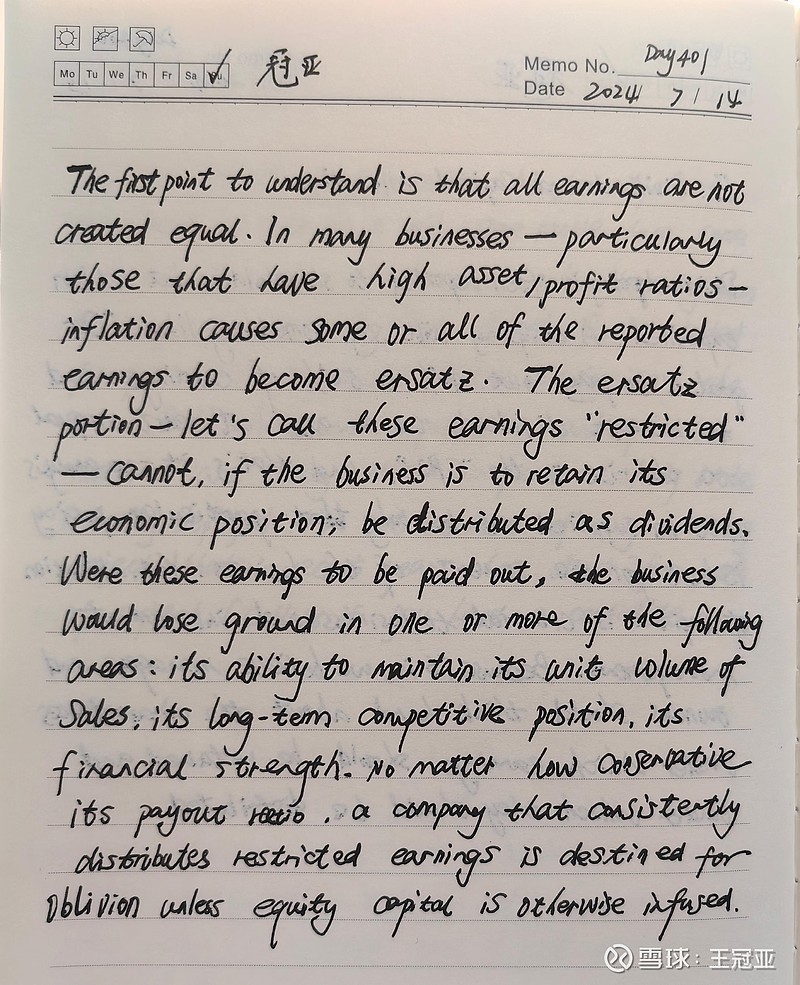

原文:The first point to understand is that all earnings are not created equal. In many businesses particularly those that have high asset/profit ratios—inflation causes some or all of the reported earnings to become ersatz. The ersatz portion—let’s call these earnings “restricted”—cannot, if the business is to retain its economic position, be distributed as dividends. Were these earnings to be paid out, the business would lose ground in one or more of the following areas: its ability to maintain its unit volume of sales, its long-term competitive position, its financial strength. No matter how conservative its payout ratio, a company that consistently distributes restricted earnings is destined for oblivion unless equity capital is otherwise infused.(1984)

释义:1.“ersatz”意为“伪造的”、“劣质的”;

2.“lose ground”意为“失去地盘”、“失利”;

3.“oblivion”意为“被摧毁”;“infused”意为“注入”。

精译:首先要明白的是,并非所有的盈利都是平等的。在很多企业,尤其是那些资产/利润比率较高的企业,通货膨胀会导致部分或全部报告的收益化为泡影。如果企业要维持其经济地位,那么受到通货膨胀蚕食的那部分利润(我们称之为“限制性利润”)就不能作为股息分配。如果这些利润被分配给股东,企业将在销量、财务实力、长期竞争地位等一个或多个领域失去优势。无论其派息率多么保守,一家持续分配限制性利润又不以其他方式增资的公司,注定会被市场所遗弃。(1984年)

心得:利润是否需要再投入,是衡量企业是否优秀的重要标准之一。我们来重温一下《穷查理宝典》中芒格的经典表述:有这么两类企业,第一类每年赚12%,你到年底可以把利润拿走。第二类每年赚12%,但所有多余的现金必须进行再投资——它总是没有分红。这让我想起来那个卖建筑设备的家伙——他望着那些从购买新设备的客户手里吃进的二手机器,并说:“我所有的利润都在那里了,在院子里生锈。”我们讨厌那种企业。

手抄:

朗读:大家请自由发挥,哈哈哈!大家的手抄原文,也可以在评论区上传打卡。