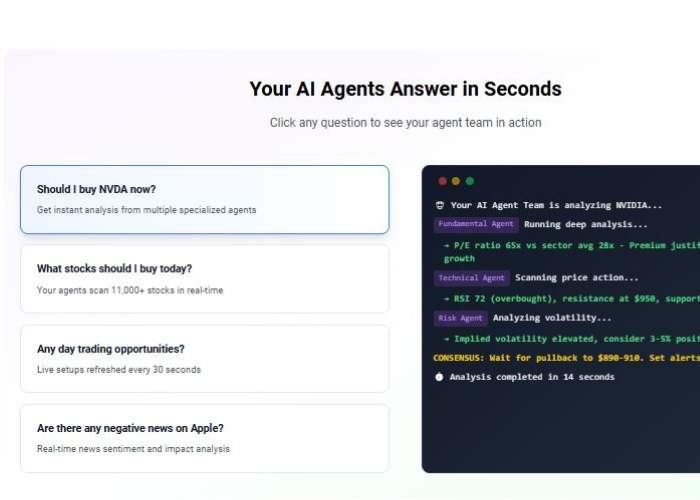

You stumble upon Kavout expecting an AI‑bot but find a quant‑first investment assistance platform. It’s not executing trades for you—it’s more like a Swiss army knife for stock insight: Kai Score, InvestGPT chatbot, smart signals, portfolio tools. Powerful, if you dig data—not perfect if you’re hunting automatic order bots.

What Kavout Offers (and What It Doesn’t)

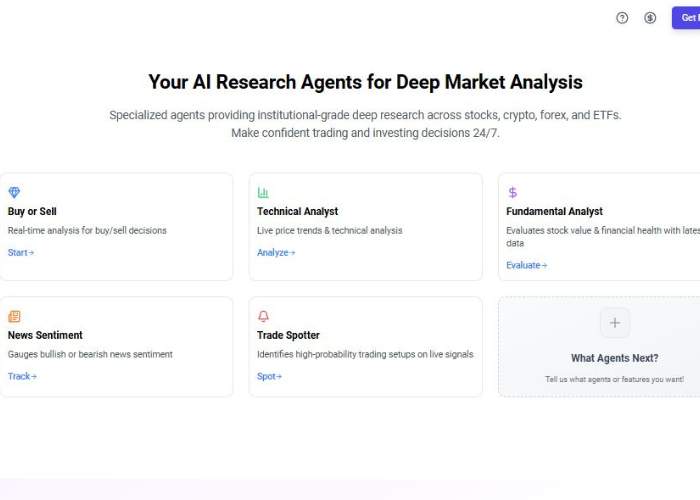

Kavout uses machine learning to analyze over 9,000 US stocks daily, crunching fundamentals, technical indicators, sentiment and alternative data. Output? A proprietary Kai Score (1–9) that reflects which stocks might outperform. It also has:

- AI Stock Picker: daily top picks ranked by Kai ScoreSmart Signals: real-time trend/momentum alerts across stocks, ETFs, crypto, forexInvestGPT: market‑specific chatbot that answers your investment questions in plain EnglishMarket Movers dashboard: intraday highlights—breakouts, momentum, sector playsWatchlists & Custom Alerts: track signals and get notified based on your custom criteriaPortfolio Toolbox: factor tilts, risk diagnostics, portfolio construction tools

Important: Kavout provides insights, not trade execution. You still need to act manually or link to an external bot if you want automation.

My Hands-On Experience (Story Jump)

Signed up, poked around free plan for Kai Score and InvestGPT prompts. Felt sharp, intuitive. Then a Kaia Score‑7 pick flagged; I bought manually—but market reversed. Learned quickly: even high AI confidence can be wrong. Took a beat, asked InvestGPT why—got reasoned explanation. That pause helped me avoid panic.

Then Smart Signals pinged a momentum setup across multiple timeframes. I added it to a watchlist, tracked in real time—entered manually. A 1.8% quick gain later, I felt the thrill. Felt like a teammate whispering “heads‑up.”

But complexity hit once I opened Portfolio Toolbox—multi‑factor allocations and exposure charts felt heavy. If you’re new to factor investing, brace yourself for a learning curve. Still, the emotional payoff: when a tech‑tilted portfolio diagnosed correctly, I felt capable—empowered.

Feature Breakdown Table

| Feature | Functionality | My Take – Real Insight |

| Kai Score (1–9) | Unified stock rating from AI over 200+ factors | Simple to read, yet you still need your own judgment |

| AI Stock Picker | Daily top‑ranked stock ideas | Great starting points—just don’t treat them as gospel |

| Smart Signals | Multi‑timeframe trend/momentum alerts | Good heads-up, but not perfect timing |

| InvestGPT | Ask investment questions conversationally | Works surprisingly well—just double-check the outputs |

| Market Movers | Tracks Movers across stocks, ETFs, crypto, forex | Useful look-up table for intraday trades |

| Watchlists & Alerts | Custom criteria-based notifications | Keeps you organized when juggling multiple strategies |

| Portfolio Toolbox | Factor-based analysis, exposure reports, portfolio construction | Powerful, but potentially overwhelming at first |

Pros & Cons (from my lens)

Pros:

- Kai Score distills complexity into a quick rating systemInvestGPT is actually conversational—you forget it’s AI until it nails a reasoned answerComprehensive tools: signals, stock picker, portfolio builder, market movers, chat supportResponsive UI, easy to scan through signals quicklyAffordable pro plan (~$20/month) with full access

Cons:

- No direct trade execution—insights onlyLimited transparency about model methodology—black‑box Kai Score WallStreetZenSteep learning curve for portfolio and factor modulesUS‑only stock universe, less global coverage Unite.AINot built for ultra-fast traders who want bots that fire instantly

Emotional Journey & Empathy

First day: excited as I scrolled through high Kai Score picks. Day two: deflated when picks didn’t pan out—felt that gut punch of mismatch. That’s when InvestGPT explanation brought me back—AI reasoning combined with calm clarity.

Later: cautious optimism as I logged small wins. Felt like learning to ride a bike—with training wheels at first. And knowing others have flagged opacity of AI models—I felt validated in digging behind the score.

Pricing & Value

Free tier limits prompts and signals. Pro plan (~$20 per month) removes caps, unlocks everything including InvestGPT, Smart Signals, portfolio tools. That’s decent value if you plan to actively research daily. Compared to tools like Tickeron (pattern recognition bots), Kavout focuses more on insight and screening.

Who Should Try Kavout?

- DIY investors who value data-driven screening over executionSwing traders wanting AI‑ranked ideas and real-time alertsAnalysts/advisors who want portfolio diagnostics and factor toolsTech‑savvy investors willing to parse Kai Score signals

Not ideal if you seek fully-automated bots or want global asset coverage. Also, for users who prefer transparency over AI black boxes, be aware: Kavout simplifies, but doesn’t expose its full algorithm.

Wishes & Suggestions

- More transparency about Kai Score’s model components—makes trust easierGlobal stock universe expansion beyond US-onlyAdd low-latency alert options for intraday tradersEducational walkthroughs for Portfolio Toolbox and factor modelsVisible reminders before billing renewal—some platforms forget that courtesy

Final Take (My Honest Opinion)

Kavout impressed me as a smart, analytical AI companion—not a robot trader. It helps you identify and analyze stock opportunities quickly. The emotional arc is familiar: initial hype, cautious testing, some disappointments, then small validation through consistent logic. You still need discipline—but with this, you get intelligent signals at scale.

If you’re looking for market-beating picks via an AI assistant and you’re comfortable making manual trade decisions, Kavout is worth a try. Kick the tires on the free tier—you’ll see if Kai Score clicks with your intuition.

Need help crafting InvestGPT prompts or scanning Kai Score‑driven picks? I’m happy to help brainstorm queries or screen setup ideas.