You jump into Coinrule with curiosity—heard it’s a rule‑based crypto bot that’s beginner‑friendly, no code required. So I signed up, linked Binance via API (no withdrawal rights, secure), and got stuck in building my first rule. How intuitive is it really?

What Coinrule Actually Offers

Coinrule brands itself as a no‑code automated crypto trading platform. It lets you build bots via drag‑and‑drop “if‑this‑then‑that” rules, test them in a demo wallet, backtest via TradingView, and execute live trades on major exchanges like Binance and Kraken. Key features include:

- Demo trading wallet (virtual USDT + BTC)Pre‑built strategy templatesTradingView integration and backtestingAdvanced indicators, trailing orders, futures supportAny‑coin scanner to auto-scan across marketsOne‑on‑one training sessions at higher tiersFree Starter plan with limitations

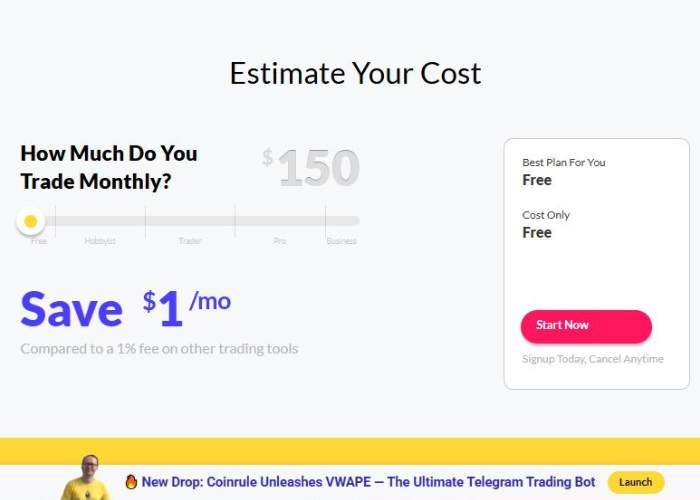

The platform currently supports about 10 crypto exchanges. Pricing tiers range from a free plan to Fund/Enterprise costing up to $749/month. A bit steep if you’re cautious.

My Real‑World Head‑to‑Tail Experience

I started on the free plan, set up a demo rule: “Buy ETH when RSI dips below 30, sell at +3% profit.” Ran it in demo mode—felt safe. Pro tip: demo slippage is ignored and fees aren’t replicated, so results are aspirational.

After feeling confident, I promoted the rule live (on a paid tier) and watched it execute. The buy happened fine, but then price swung against me—stopped out. Learning moment: real markets don’t behave like neat simulations.

Then I tried a trailing‑stop Momentum strategy template. A small profit materialized overnight. That 2% win kind of felt like redemption.

Support? I had to ask a question about rule logic; their response was helpful and quicker than I expected. Trustpilot reviews also echo responsive support.

However, Reddit users caution: system overload during high volume has caused missed trades and losses. One user said Coinrule isn’t real AI, it’s rule-based and when volume surges, the system fails.

Key Features at a Glance

| Feature | What It Does | My Take |

| Demo Wallet & Backtest | Simulate rules without real money | Safe playground, but realistic slippage is missing |

| Prebuilt Templates | Ready‑made strategies for common setups | Nice time-saver, though many locked behind paywalls |

| Rule Builder (no code) | Drag‑and‑drop IF/THEN logic, plus multiple conditions | Friendly UX, yet logic can be rigid |

| TradingView Integration | Backtest via TradingView history | Required if you want deeper validation |

| Any‑Coin Scanner | Scans across supported exchanges and assets | Great for opportunistic rules across altcoins |

| Futures Support & Trailing | More advanced order types | Solid for pros, but requires paid plans |

| One‑on‑one coaching | Personal training sessions at top tiers | Nice touch if you’re serious |

Pros & Cons: From My Desk

Pros:

- Clean, intuitive UX—friendly to beginnersNo coding required to build strategiesDemo wallet and TradingView integration help reduce riskPowerful templates and logical operators allow complex rule-buildingTrailing orders and futures support for more advanced execution

Cons:

- Many templates are paywalled behind higher tiersDemo mode doesn’t simulate slippage or real fees accuratelyLimited supported exchanges—roughly tenPricing can get high fast if you scale up volumeNot actual AI—purely rule-based automation; system may falter under heavy load

Emotional Rollercoaster: My Feelings Through the Process

Morning 1: pumped — built a rule and watched the demo. Felt like a wizard.

Day 2: disappointed — real execution hit stop‑loss. That stung.

Day 3: optimistic — trailing stop kicked in. Gained 2% and felt validation.

Night 4: anxious — system lag in alerts delayed execution, small losses.

Morale: exploring, tweaking, making mistakes, and learning. Trading isn’t linear and bot setups don’t guarantee profits—but the feedback loop kept me engaged.

Pricing Breakdown

| Plan | Monthly | Exchanges Allowed | Rule Count | Backtesting / Demo |

| Starter | $0 | 1 | 1–2 | Yes |

| Hobbyist | ~$30 | 3 | ~10 | Yes |

| Trader | ~$60 | ~5 | 50 | Yes |

| Fund | ~$749 | Unlimited | Unlimited | Yes + 1‑on‑1 |

Free plan is tight, but good to start. Bigger plans get you futures, more rules, coaching. Note: pop-ups pushing upgrades on free tier get annoying fast.

Who Is This For?

- Newcomers wanting simple rule automation without codingTraders who want to test strategy ideas risk-free before going liveUsers who rely on well-laid templates with drag‑and‑drop logicPeople comfortable executing rules manually and monitoring live trades

Not ideal if you expect machine learning AI or ultra-robust execution under extreme volume. Also not for users wanting built-in trade placement journies like 3Commas where everything’s bundled.

Suggestions for Improvement

- Simulate real slippage and fees in demo mode for realismUnlock more templates in lower tiers to avoid paywall guardExpand exchange support—user demand is growingPre‑charge billing reminders before annual renewalGreater transparency about system capacity limits during volume spikes

Final Verdict

Coinrule is a well-designed, no-code rule‑based crypto trading bot platform. It’s approachable, visually clean, and full-featured for basic to intermediate automation. Template logic works, demo-testing builds confidence—but real market conditions expose its limitations.

It’s not “AI,” but it is powerful automation. If you trade modest volume and want sanity automation, it’s worth a try. Always start in demo mode, test on small volumes, and watch your rules like a hawk.

Give that free plan or 7‑day demo a spin. If your trades click and you feel comfortable tweaking rules, upgrade for more power. But don’t expect fireworks—you still need smart strategy and risk sense.

Need help writing a rule for trailing buy or combining scanner filters with profit triggers? Want rule ideas that survived real dips? I’m happy to walk through examples.