The Indian motor insurance market is currently valued at around $13.19 billion and is projected to reach $21.48 billion by 2030. While the industry continues to grow steadily, regulators have also issued strong mandates to insurers to improve their turnaround times and provide better customer experiences.

For one of India’s biggest private insurers, which prided itself on a high claim settlement ratio, this meant finding new ways to streamline its back-office processes and reduce manual errors. But it wasn’t easy. They process more than 350,000 cases annually— each file contains over 10 types of documents, varying formats and structures, 30+ line items, and multiple ingestion channels. They had a backend team of 40 data entry clerks and automobile experts manually inputting information from repair estimates, invoices, and supporting documents into their claim management system

This inefficient, unscalable workflow couldn't meet the regulator's turnaround time mandates, forcing a re-evaluation of their motor claim processing approach. Let’s explore how they went about it.

What changed in motor claim processing in 2024

In June 2024, IRDAI, the Indian insurance regulator, issued new guidelines aimed at improving motor insurance claim settlement processes.

The key changes included:

- No arbitrary rejection of motor insurance claims due to lack of documents — insurers must request all required documents upfront during policy issuanceInsurers must allocate a surveyor within 24 hours, obtain the survey report within 15 days, and decide on the claim within 7 days of receiving the survey reportMandatory customer information sheet (CIS) to provide clear policy details and claims processRestrictions on policy cancellation, allowing it only in cases of proven fraud with 7-day noticeRequirement to disclose the insured declared value (IDV) calculation method

As the insurer’s business grew rapidly, these regulatory challenges made handling close to 30,000 claims monthly became more than just a processing challenge. It exposed fundamental operational constraints that threatened their ability to scale and deliver value to customers.

Let’s explore how these changes affected the insurer's business:

- Couldn’t scale their operations without adding head count.Unable to meet IRDAI's mandatory claim settlement timelines – risking regulatory penalties for violationsGetting poor reviews and negative feedback from customersAutomobile experts spending valuable time on data entry instead of cost assessment

These challenges made it impossible for them to justify premium increases based on actual claim costs and risk profiles.

Why manual claim processing was complicated

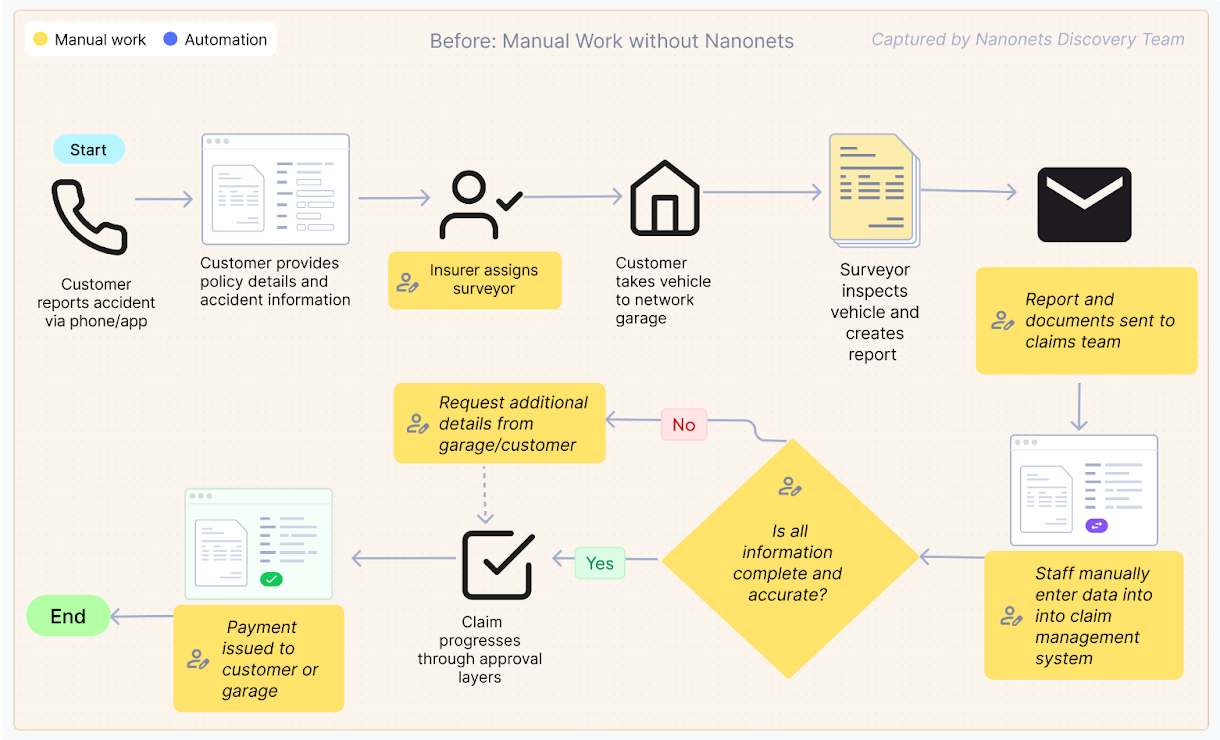

Let’s first try and understand what the insurer’s claim processing workflow used to look like.

1. When an accident occurs, the customer can either call up the insurer's toll-free number to register the claim or use their proprietary mobile app to complete the claim form.

2. During this, customers will be asked to share policy number, vehicle details (make, model, registration number, etc.), accident or damage details, and police report (if applicable).

3. The customer is then asked to take the vehicle to one of the insurer's authorized network garages for inspection and repair. They need to submit the required documents to the surveyor assigned by the insurer.

4. The surveyor would inspect the vehicle and prepare a report, which would then be submitted to the claims team.

5. The claims team would then assess the surveyor's report and the documents submitted, evaluating factors like vehicle identification, part numbers, unit pricing, and overall claim validity.

6. After the assessment, the team would manually enter the relevant details into the claims management system.

7. The claim would then go through multiple layers of approval before the settlement amount could be disbursed to the customer or the garage (in case, the customer opts for cashless mode)

The backend team, consisting of 40 data entry clerks and automobile experts, manually inputs all the key details from the claim file into their proprietary claim management system. This included capturing information from different document types, such as estimates, invoices, registration certificates, driving licenses, and more.

Remember that these documents are issued by different sources. For instance, a driver's license issued in one state may not follow the same format as the one issued in another state.

The team would meticulously review each line item and part number to ensure accuracy before the claim could be further processed and approved. Another challenge was the inconsistent naming conventions for parts across different garages and manufacturers – the same component would have different names depending on who submitted the document.

For instance, what appears as a front bumper on one estimate might be listed as a bumper cover on another. Similarly, the component called a boot in documents from UK and German manufacturers would show up as a deck or trunk in manufacturers from other countries. Without a standardized database, these variations created constant confusion.

Mismatches in vehicle identification or part numbers, incorrect unit pricing, or missing documents would cause the claim to go back to assessment. This entire process could take anywhere from 15 to 30 days, falling short of the new regulatory timelines.

When claims extended beyond IRDAI's mandated settlement periods, the consequences were both regulatory and commercial. On the regulatory side, the insurer faced monetary penalties and show cause notices. Commercially, these delays damaged their market reputation and prompted formal customer complaints, which require significant time and resources to resolve. The extended processing drove up operational costs, as claims needed additional touchpoints and prolonged handling, also resulting in customer dissatisfaction.

The insurer quickly realized that this inefficient workflow could not keep up with the growing business demands and the stricter regulatory requirements.

How the insurer automated its claim processing workflow

The insurer knew they had to step up their game. Some of the competitors, especially the fully digital-first insurers, had already started rolling out zero-touch claim processing.

They explored multiple OCR solutions, but quickly realized such tools won’t cut it. These tools were heavily dependent on format and structure consistency. This led to formatting errors and inconsistent extraction, and more manual interventions. And to make matters worse, they could only feed certain document formats into the system, leaving a significant portion of the claim files untouched.

The insurer figured out they needed a format-agnostic solution that could handle all document types, extract the right information, and integrate seamlessly into their existing claims management system. After evaluating multiple AI-powered document processing platforms, they chose to go with Nanonets’ Intelligent Document Processing (IDP) solution.

Here’s why:

- Simplicity of the PDF extraction workflowsLine item extraction accuracyAPI and system integration capabilitiesAbility to handle all document formats, including handwritten and semi-structured documentsMulti-lingual capabilities

We at Nanonets worked with the insurer to create a tailored document processing solution that fit their specific claims workflow. The implementation focused on incremental improvements rather than a complete overnight transformation.

The team began by tackling the most critical documents in the claims process: estimates, invoices, and pre-invoices. These documents contain the essential information about vehicle damages, required repairs, and associated costs.

The initial phase focused on:

- Configuring OCR models to extract line items from repair invoices and estimatesCreating systems to distinguish parts from labor costsBuilding validation rules to flag potential data inconsistenciesIntegrating with the insurer's application on their proprietary claim management system via API

The workflow was straightforward. Here’s what it looked like:

- Claim initiation and document collection: When a claim event occurs, policyholders initiate the claim form through the insurer's user interface or customer service. The claim form collects basic details along with essential documents including repair estimates, invoices, and supporting documentation.Document submission to Nanonets: Once uploaded to the insurer's system, these documents are automatically routed to Nanonets via API integration. Previously, a team of 40 backend employees would manually review and enter information from these documents into their system.Intelligent document processing: Nanonets processes the documents using specialized models to:

- Classify each document type automatically (invoice, estimate, registration certificate, etc.) and route it to the right data extraction modelThe model extracts structured data from both standardized and non-standardized formatsRead and organize line items from repair estimates and invoicesDistinguish between parts and labor charges using keyword recognition

- Standardizes varying part names across different garages (bumper vs. cover)Identifies potential child part replacements (such as door skin versus entire door assembly)Categorizes materials (plastic, glass, metal) for proper cost analysis

The initial implementation focused on core documents (estimates, invoices, and pre-invoices), with plans to expand to supporting documents like driving licenses, registration certificates, travel permits, fitness certificates, and tax documents.

The impact of automating insurance claims processing

It’s been only three months since the implementation, but the new workflow has already shown promising signs for the insurer.

Let’s take a look at the impact:

- 1.5 million pages processed in three months, almost double the previous volume of 760,000 pagesStandardized naming for approximately 600 common parts that cover 90% of claimsSystematically identify opportunities for child part replacements (like a door skin at ₹5,000 versus an entire door assembly at ₹20,000) – saves a ton of costEnable staff to spend less time on data entry and more on document review and exception handlingEasier to meet IRDAI's regulatory timelines, which require claim decisions within 7 days of receiving the survey reportCustom JSON integration enables seamless data flow between Nanonets and the insurer's claim management system

Right now, the focus is on the core documents — estimates, invoices, and pre-invoices — as the team gets comfortable with the new process. After that, we’ll cover the remaining document types like driving licenses and registration certificates in the next phase — this should cut manual work by 50%.

What’s next

The next phase will expand document processing to include supporting documents like driving licenses, registration certificates, travel permits, fitness certificates, and tax documents. Additionally, we’re working with the same insurer, automating their medical claims processing workflow.

If your insurance company is struggling to deal with mounting paperwork and missing regulatory deadlines, we can help. Nanonets works with your existing systems to deliver real improvements without turning your operation upside down. Ready to see it in action? Schedule a demo today.