Published on March 4, 2025 5:37 PM GMT

Epistemic Status: I am not an energy expert, and this was done rather briefly. All analysis uses pricing data specific to Ireland, but some general ideas are likely applicable more broadly. Data is true as of March 2025. Where there are uncertainties I try to state them, but there are likely some factual errors.

TL;DR:

Now that batteries have gotten so cheap (approx 50-100€/kWh), it seems surprising that there is so much temporal price discrepancy to buy energy at low prices and sell/use energy at higher prices. In Ireland, the arbitrage opportunity per year seems to be on the order of ~45€/kWh per year on day-ahead wholesale markets, possibly more on balancing markets, and ~62€/kWh for households.

The main factors seem to be:

- Costs for connecting batteries (hybrid inverters, battery management systems, etc..) seem to add up to more than the cost of the batteries now in most casesIt takes a while for the market to update.

- For the wholesale market: Installing GWh scale battery storage locations takes a lot of time to provisionFor households: pre-packaged solutions seem to be much more expensive than what one could do DIY, leading to much slower payback times

While the naive ROI seems to be within 2 years, equipment and other costs increase the payback period to more like 3-7 years. Overall, it seems like while there is some investigation and investment in this space, it does not seem to be matching the potential demand, with a possible main factor that may lower longer-term profitability being that there will be an interlink built between Ireland and France in 2026, which will likely reduce the price volatility somewhat.

Battery Cell Costs

Battery manufacturing capacity has gone up a lot, and prices have come down. In 2010, prices were around 1191$/kWh, dropping to 384 $/kWh in 2015, and 137 $/kWh in 2020 (accoriding to Statista). However, prices have continued to drop, and priced can be as low as $53 per kilowatt-hour (Fanatical Futurist). China's overall battery manufacturing capacity has exploded and is reported to exceed demand by more than double.

As a starting point, we need some examples of how much batteries actually cost. I try find some examples online. I do not endorse any of these sellers, and have never bought batteries from any of them, but I find typical discussion using "online approximate figures" as not being sufficiently concrete.

Anyway, these are some examples of Chinese and EU battery suppliers, mostly reselling from Chinese manufacturers:

Chinese-based sellers, often no label

Most of these don't include VAT or shipping.

| Chinese Supplier | Cell Type | Cost per cell | €/kWh | Notes |

|---|---|---|---|---|

| Shenzhen Soec | 280Ah (3.2V) = 0.896kWh | $79-$86 | €84-€91 | sold as Grade B, 6500 cycles |

| EVE Energy | 280Ah (3.2V) = 0.896kWh | $66-$74 | €67-€78 | sold as Grade B, 8000 cycles |

| PWOD | 320Ah (3.2V) | €83.00 | €81 | Sold as Grade A, 8000 cycles, EU stock with VAT included |

| SZXUBA/REPT | 280Ah (3.2V) = 0.896kWh | $85-$90 | €90-€95 | sold as "Grade A", but may be grade B |

| Docan Power | EVE 304Ah (3.2V) = 0.972kWh | $56-$61 | €55-€59 | sold as "Grade A", but may be grade B |

EU/UK Resellers, with battery brand name attached

I think most of these include VAT, and are mostly EU/UK stock (there may be proxy buyers but it's hard to check).

| EU Supplier | Cell Type | Cost per cell | €/kWh | Notes |

|---|---|---|---|---|

| Basengreen (DE) | EVE 280Ah (3.2V) = 0.896kWh | €1024 per 16 | €72 | Sold as Grade A, 8000 cycles, EU store |

| Fogstar (UK) | EVE 280Ah (3.2V) = 0.896kWh | £65 | €82 | Grade A cells; UK stock |

| Fogstar (UK) | Envision 280Ah (3.2V) = 0.896kWh | £55 | €69 | Grade B cells; UK stock |

| NKON (NL) | Envision 280Ah (3.2V) = 0.896kWh | €53-€57 | €59-€63 | Grade A cells; EU stock incl VAT; 6000 cycles; actual capacity ~305Ah |

| NKON (NL) | EVE MB31 314Ah (3.2V) = 1.005kWh | €66.07-€85.95 | €65.74-€85.52 | Grade A cells; EU stock incl VAT; 8000 cycles |

| EV Europe | Winston 300Ah (3.2V) = 0.96kWh | €370.00 | €383.33 | LiFeYPO4. Not sure why they are so expensive. |

I don't know if all of these are legit, but a quick check on perplexity seems to suggest that at least most of the european ones are. As a conservative estimate, I will use the pricing of ~79€/kWh, though there do seem to be prices as low as ~50€/kwh.

Wholesale energy market temporal arbitrage

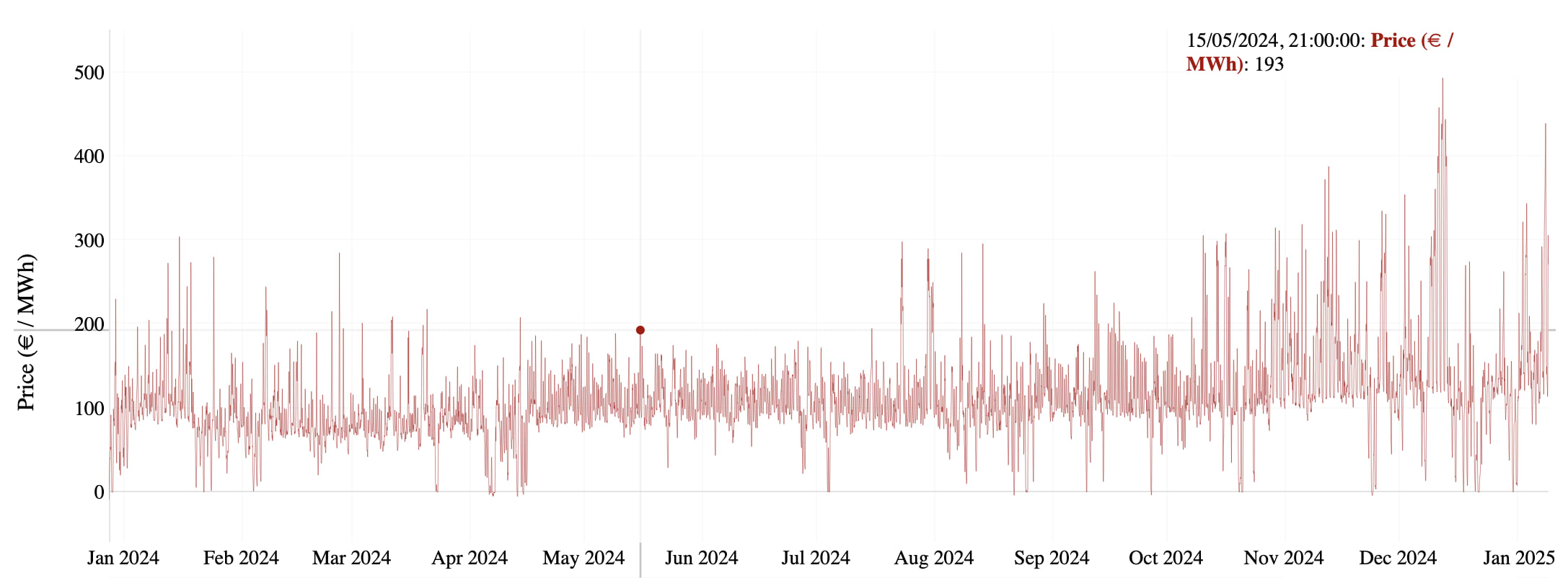

The wholesale energy markets work on multiple timescales, with various contracts for price vs timescale. In Ireland, one can view historic day-ahead hourly prices, or the intraday market. and I use this to get some approximate estimates for potential profitability.

How Wholesale Energy Markets Function in Ireland

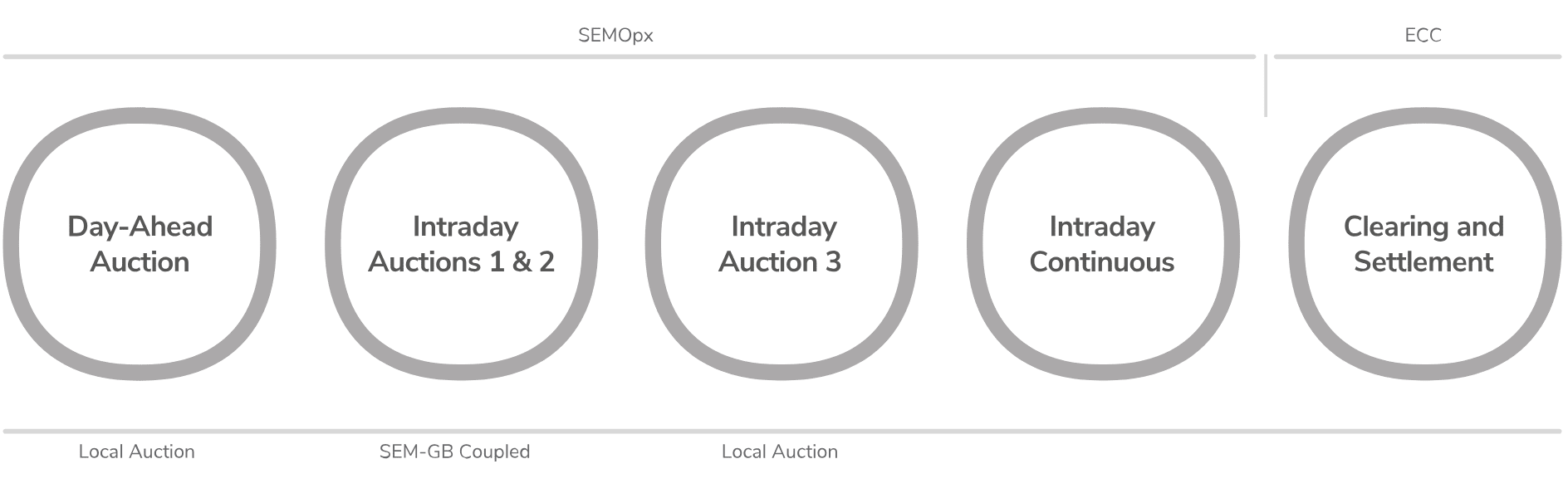

TL;DR: Ireland's electricity market operates through four sequential trading timeframes: (1) Day-Ahead Market at 11:00 AM plans the next day's generation; (2) Intraday Auctions at 3 PM, 7 PM, and 10 PM allow position adjustments; (3) Continuous Trading continues until one hour before delivery; and (4) Balancing Market resolves final imbalances in real-time, with the highest price volatility and arbitrage opportunities.

Ireland operates its electricity market through the Integrated Single Electricity Market framework since 2018, same as most of Europe. Like most modern electricity markets, it features multiple trading timeframes that create opportunities for arbitrage. Most prices here are shown in MWh, but later on I switch to using kWh since it is easier to compare with battery prices.

The general analysis probably somewhat holds to other markets, there are some feature of the Irish market that may lead to higher price volatility. Its has a lot of wind generation (35% of total electricity production) creates predictable daily patterns but also significant volatility. Typically, prices reach their lowest points overnight (midnight to 5AM) when demand is minimal and wind often plentiful. Evening peaks (5PM to 8PM) generally command the highest prices, creating a reliable daily spread of €35-65/MWh that storage operators can exploit.

Ireland's somewhat isolated grid (connected to Great Britain, and this indirectly but not directly to continental Europe) also contributes to price volatility. While a new interconnector to France is planned for 2026, the current limited connections mean that surplus renewable energy cannot always be easily exported, occasionally resulting in negative prices during particularly windy, low-demand periods. Conversely, during calm weather, the system may rely on expensive gas-fired generation, pushing prices substantially higher.

The Bidding Process Explained

The Day-Ahead Market serves as the foundation of electricity trading, where most power is bought and sold for the following day. Each morning, generators submit offers indicating how much electricity they can produce and at what price, while large consumers and suppliers submit bids for their expected needs. A sophisticated algorithm matches these bids and offers to establish hourly prices for the next day, typically published by early afternoon. This market handles most electricity transactions, setting the baseline for energy costs.

The Day-Ahead Market uses a sealed-bid auction system with specific timing requirements. By 11:00 AM each day, all participants must submit their bids and offers for each hour of the following day (24 separate auctions effectively run simultaneously). Generators typically offer multiple price-quantity pairs – for example, offering 50MW at €60/MWh, another 30MW at €75/MWh, and so on, reflecting their increasing marginal costs as they ramp up production.

The auction follows a "uniform pricing" model, meaning all successful bidders receive the same market clearing price regardless of their original bids. This clearing price is determined by the most expensive generator needed to meet demand (the "marginal unit"). For example, if demand requires 1000MW of generation, and the 1000th MW comes from a generator that bid €85/MWh, then all successful generators receive this €85/MWh price – even those who bid much lower.

For the day-ahead market, I do some very simple analysis assuming perfect information.

Intraday Auctions: After the day-ahead market closes, three sequential Intraday Auctions provide opportunities to adjust positions as forecasts improve:

- IDA1 occurs at 15:00 (3 PM) on the day before delivery, coupled with Great BritainIDA2 follows at 19:00 (7 PM), still coupled with Great BritainIDA3 closes at 22:00 (10 PM), focusing purely on the Irish market

These structured auctions allow participants to refine their positions as weather forecasts (particularly important for wind generation) become more accurate closer to delivery time. I considered doing some analysis here, but the data (at least for IDA1) was mostly similar to the day-ahead market so I didn't bother.

Continuous Intraday Market: Between the final intraday auction and one hour before delivery, the Continuous Intraday Market operates similar to a stock exchange. Participants can post buy or sell orders at any time, which are matched when compatible counterparties are found. These trades occur on a "pay-as-bid" basis, meaning each transaction settles at the price specified in the order rather than a uniform market price. I tried to do some analysis here, but the low liquidity sporadic data meant that it would likely work better with a more sophisticated model that incorporates all the data.

Balancing Market: Finally, the Balancing Market operates from one hour before delivery through real-time operation. Ireland's grid operator (EirGrid) takes active control to resolve any remaining imbalances between generation and consumption. There are also price caps in this market, reaching €4,000/MWh under normal conditions and can spike to €10,000/MWh during scarcity events – creating the most extreme price volatility in the entire electricity market sequence.

My understanding is that the balancing market is the most profitable market for batteries, as prices can swing dramatically within minutes based on unexpected generation shortfalls or surpluses. Batteries' ability to respond within seconds makes them ideal for capturing these high-value periods, with price spreads of several hundred euros per MWh possible within a single hour. I would have liked to do some analysis here, but I couldn't find the data.

Day-Ahead Market Arbitrage Analysis

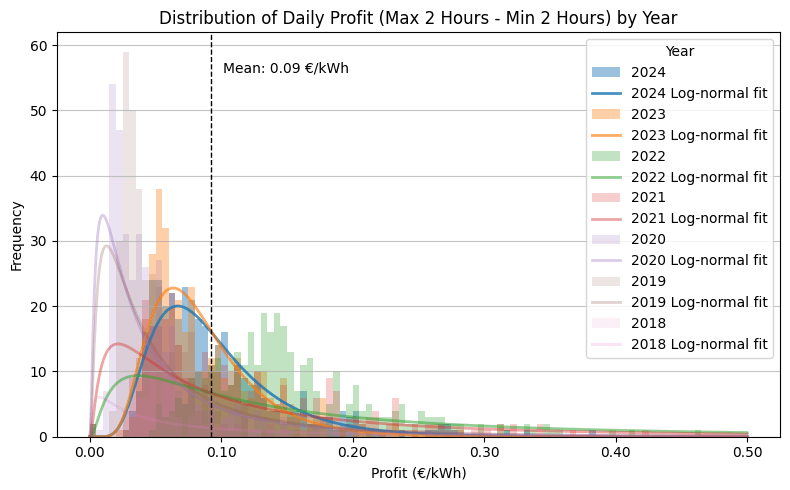

As a starting point, we can try the simplistic example, where we ignore all other constraints, and can buy 0.5 units during the cheapest times and can sell 0.5 units during the most expensive times. This first simplistic analysis doesn't actually check time things are in the right order, but we can get a brief approximation for how prices are distributed and how much profit potential there is, and how much it has changed over the years.

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|

| Profit (€/kWh) | 7.34 | 18.66 | 17.46 | 41.03 | 56.02 | 31.67 | 35.07 |

We can see above that in 2024, arbitrage profits from batteries could have been up to €35/kwh per year from the very simplistic trading strategy. Importantly, we can see that the variability in prices has gone up significantly since 2022.

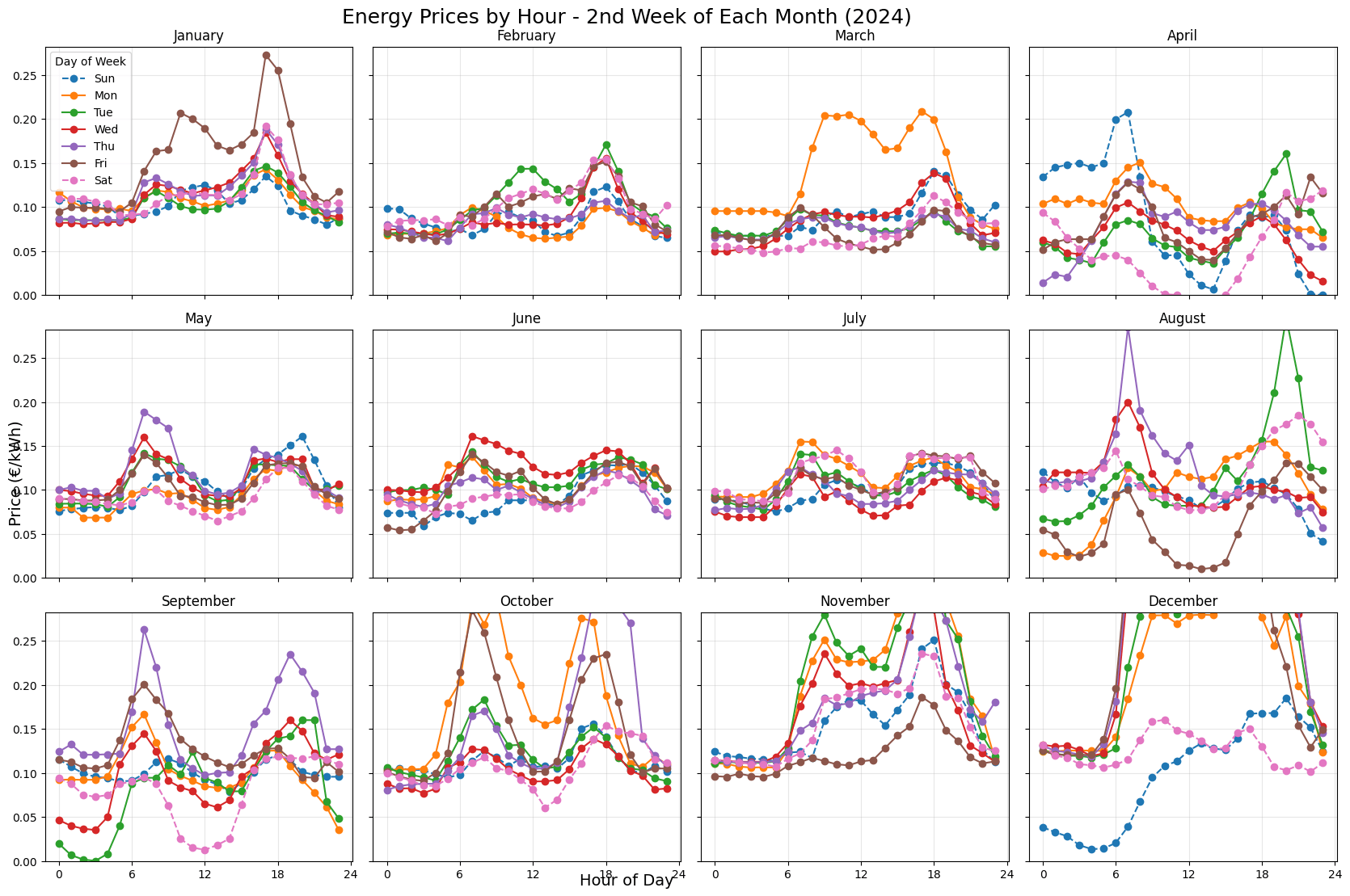

However, since there is often predictable variation during the day of how people use energy, we can actually do better. We can see that, while not perfect, there are clear predictable trends in what times seem to show the most demand, with peaks in the morning and in the evening.

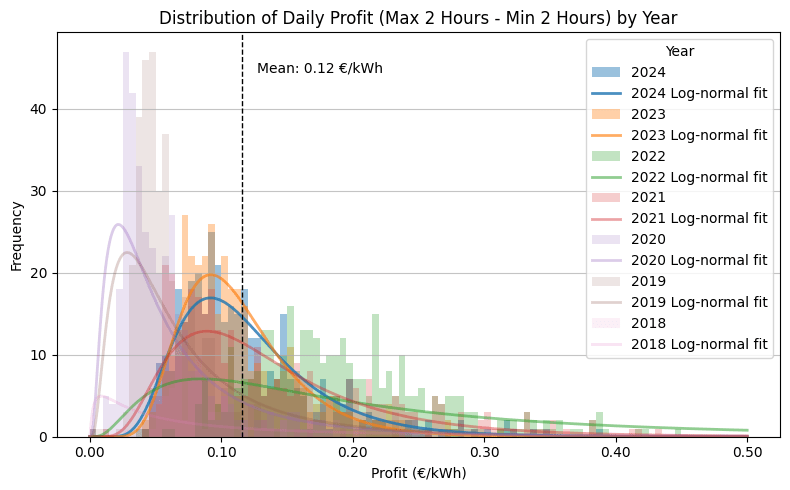

As an upper bound, if we assume a perfect trading strategy, trading multiple times per day, we could have had arbitrage profits of up to €44.49/kWh in 2024:

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|

| Profit (€/kWh) | 8.69 | 23.21 | 21.05 | 50.95 | 71.08 | 41.52 | 44.49 |

So how does this compare to possible costs?

Estimated costs - 100MWh Battery Plant

Honestly, I have no idea how much this should cost. I am mostly deferring to Claude/Perplexity/ChatGPT for most of this data analysis. I feel like these numbers are possibly too low. I guess the actual components probably do not mix and match as well as I have assumed here, but as an estimate it's probably OK.

Capital Expenditure (CAPEX) Breakdown

It is hard to find many projects that have public cost breakdowns. Probably some key components are below (see these message transcripts for more details, I do not trust them that much):

- Battery Cells: €5-10M for 100MWh

- Low-cost: €50/kWh = €5MMid-range: €79/kWh = €8MHigh-end: €100/kWh = €10M

- Hierarchical structure:

- Rack-level BMUs (200-400 units): €150,000-300,000 totalContainer-level controllers (10-20 units): €150,000-160,000 totalSystem-level master controller (1-2 units): €20,000-40,000 total

- Low-cost option: Chinese PCS at ~€20k per MW (€200k total)Mid-range option: Standard PCS at ~€60k per MW (€600k total)Premium option: High-end inverters at ~€120k per MW (€1.2M total)

- Transformer: €50k-100k for 10MVA unitSwitchgear: €10k-40k for MV circuit breakersCooling/HVAC: €15k-60k for thermal managementWiring & Installation: €50k-200k

Total cost ranges:

- Low estimate: €5.8M (€58/kWh) - aggressive pricing, mostly Chinese components, probably missing some componentsMid estimate: €9.0M (€90/kWh) - standard components, typical pricingHigh estimate: €12.3M (€123/kWh) - premium components, European suppliersBuffer: €15M (€150/kWh) - buffer for some missing costs

Excludes land, grid connection, and development costs. A 100MWh battery installation would probably use approx 1 hectare, adding roughly €10-100k/year for rent in suburban areas to operational costs (relatively negligible compared to other costs). There are likely other costs for planning permission and such, which may also take months to years for approval.

As a possible reference point, some other projects with available numbers are available (though somewhat scarce):

European Battery Storage Projects:

- Balen Energy Storage, Belgium, 2021: 100 MWh, €30 million, (€300/kWh)RWE Neurath & Hamm, Germany, 2024: 250 MWh, €140 million, (€560/kWh)Coalburn, Scotland UK, 2025: 1,170 MWh, €920 million, (€786/kWh)

If €30M was achievable in 2021, it seems like the €15M is probably a semi-realistic estimate if one is frugal. Likely one would need to fight a bit with getting permission, grid connection, and approval, probably driving up the costs to the larger figures.

There are also likely some annual operational costs I will generously estimate as being ~500k/year, so 5€/kWh/year. This should cover a few staff, insurance, maintenance, etc.

Financial Returns

With €44.49/kWh/year potential arbitrage revenue, 85% efficiency, 95% availability, and €5/kWh/year Operational Expenses:

Using the "buffered" estimate, it would be €150/kWh / (€44.49/kWh/year × 0.85 × 0.95 - €5/kWh/year) ≈ 4.8 years. If using probably-unrealistic-best-case-scenario estimates of €60/kWh, ROI would be like 1.9 years

How deep is this market?

Ireland's energy usage seems to be around 83GWh/day as of 2023, while the current capacity as of 2025 seems to be only 2.7GWh with projections of this going up to 13.5GWh by 2030. It seems like more installation would likely be profitable for a while.

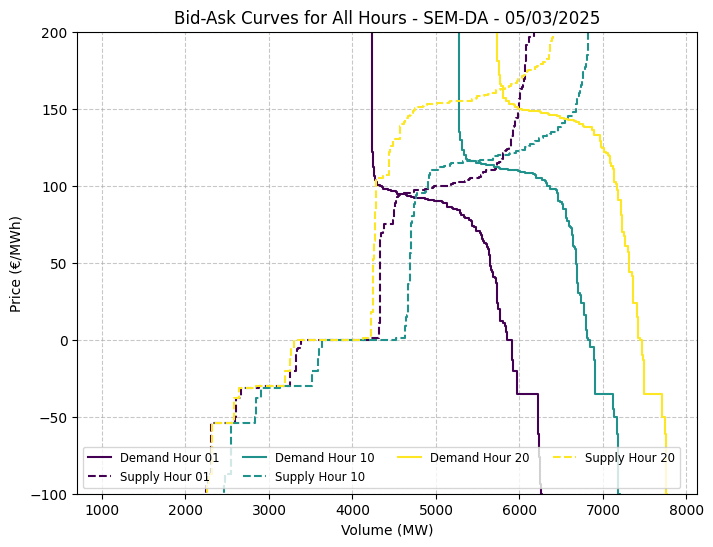

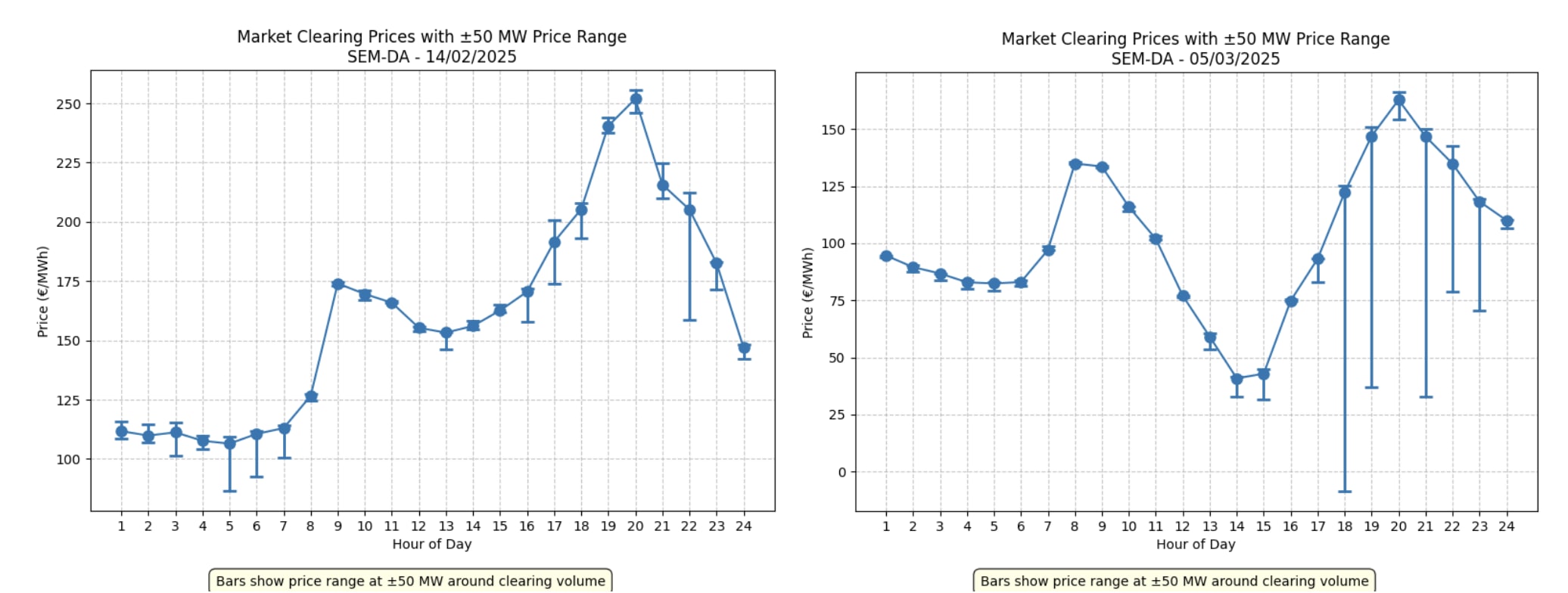

We can find bid-ask curves online. This is somewhat imperfect since if prices were always high/variable some potential participants may choose to quit the market, but we can still get a good idea. We can see an example bid-ask curve below, and a couple of example days showing the depth/change in price for 50MW:

For a typical hour we can see there is approximately a 1-2GW stable edge for supply and demand, with prices rising/falling steeply either side.

We see a couple of randomly-chosen week days, and try to estimate the spread from 50MWh either side of the price. It seems like for most hours, it is quite stable, but for others, it is extremely volatile.

These do seem to suggest that the prices would likely be pretty stable with a 100MWh plant, but that expecting profits from plants of size 1GWh+ may be less feasible as the storage would have stabilizing effects on the market.

Government Investment Perspective

While institutional investment in battery storage is increasing, it has not yet reached the scale needed to fully smooth price fluctuations in the market. There is a potential opportunity for government intervention.

Government entities with lower return requirements (e.g 4% annual return could be valid compared to 25%), which could strategically deploy battery storage to reduce market volatility:

Annual return needed = CAPEX × 4% = €150/kWh × 0.04 = €6/kWh/year Total annual earnings required = OPEX + Return = €5/kWh/year + €6/kWh/year = €11/kWh/year

Minimum arbitrage spread needed: X × efficiency × availability = Total annual earnings X × 0.85 × 0.95 = €11/kWh/year X = €11/kWh/year ÷ (0.85 × 0.95) = €13.61/kWh/year

We then compare the actual arbitrage opportunities of €44.49/kWh per year (or €0.12/kWh per day) and note we can reduce it to €13.61/kWh per year (€0.04/kWh per day). This would be a 69% reduction while remaining just about profitable.

Household energy market arbitrage

1. Basic Pricing Structure

Ireland's electricity pricing follows a multi-component structure with standing charges (€1.55-€2.20 daily) covering fixed network costs and usage rates varying by supplier and consumption pattern. The market is regulated by the Commission for Regulation of Utilities (CRU), with prices influenced by wholesale energy costs, network charges, and PSO (Public Service Obligation) levies. Most suppliers offer promotional rates for new customers, with substantial differences between headline and effective rates after all discounts. Contract durations typically range from 12-36 months, with flexible month-to-month options becoming more common through digital-first providers.

2. Tariff Types Available

Flat Rate Plans: Consistent pricing throughout the day regardless of consumption time, ranging from 23-24c/kWh with various discounts available.

Day/Night Plans: Dual-rate structure with significant differentials (day rates + night rates), requiring either a smart meter or dedicated night meter. I do not include these in the analysis

EV-Specific Plans: Specialized super off-peak rates (5-10c/kWh) during designated low-demand hours. Some require specific EV chargers, but my understanding is that they mostly just monitor the time of use.

Innovative Options: Including wind-dependent dynamic pricing, free weekend electricity (up to a low limit of 100kWh), solar export credits (up to 21c/kWh), and demand-response programs that reward consumption flexibility. I do not include these in the analysis

There are other factors, like payment method discounts (5-12%), dual fuel bundling (10-15%), digital account management (2-5%), loyalty rewards (€50-150/year), and equipment requirements. I will mostly just find what seems like a reasonably consistent online rate and use that.

Comparison of some main electricity provider plans

Day-Only Usage (4,200 kWh/year)

| Rank | Provider | Rate (c/kWh) | Standing Charge (€/day) | Standing Charge (€/year) | Energy Cost (€/year) | Total Annual Cost (€) | Effective Rate (c/kWh) |

|---|---|---|---|---|---|---|---|

| 1 | Energia | 23.61 | 0.65 | 236.62 | 991.62 | 1,228.24 | 29.2 |

| 2 | Electric Ireland | 23.82 | 0.80 | 292.00 | 1,000.44 | 1,242.44 | 29.6 |

| 3 | Yuno Energy | 23.96 | 0.60 | 219.22 | 1,006.32 | 1,225.54 | 29.2 |

Best option: Yuno Energy (23.96c/kWh)

- Energy cost: 4,200 kWh × €0.2396 = €1,006.32Standing charge: €0.60 × 365 = €219.22Annual cost: €1,006.32 + €219.22 = €1,225.54 (Requires bundling with gas service)

Second-best option: Energia (23.61c/kWh)

- Energy cost: 4,200 kWh × €0.2361 = €991.62Standing charge: €0.65 × 365 = €236.62Annual cost: €991.62 + €236.62 = €1,228.24

Super Off-Peak EV Usage (Generic Equipment Compatible) (4,200 kWh/year)

| Rank | Provider | Rate (c/kWh) | Hours | Standing Charge (€/day) | Standing Charge (€/year) | Energy Cost (€/year) | Total Annual Cost (€) | Effective Rate (c/kWh) |

|---|---|---|---|---|---|---|---|---|

| 1 | Pinergy | 5.45 | 2AM-5AM | 0.78 | 283.47 | 228.90 | 512.37 | 12.2 |

| 3 | Energia | 8.87 | 2AM-6AM | 0.65 | 236.62 | 372.54 | 609.16 | 14.5 |

| 4 | SSE Airtricity | 8.58 | 2AM-5AM | 0.84 | 305.72 | 360.36 | 666.08 | 15.9 |

| 5 | Bord Gáis | 9.31 | 2AM-5AM | 0.82 | 298.64 | 391.02 | 689.66 | 16.4 |

Best option: Pinergy (5.45c/kWh)

- Energy cost: 4,200 kWh × €0.0545 = €228.90Standing charge: €0.78 × 365 = €283.47Annual cost: €228.90 + €283.47 = €512.37

Second-best option: Energia (8.87c/kWh)

- Energy cost: 4,200 kWh × €0.0887 = €372.54Standing charge: €0.65 × 365 = €236.62Annual cost: €372.54 + €236.62 = €609.16

Arbitrage Rate Analysis

Pure Rate Differentials

As a basic pure rate differential, we can see that the best day-only plan (Energia at 23.61c/kWh) and the best super off-peak plan (Pinergy at 5.45c/kWh) creates a difference of 18.16c/kWh.

This 18.16c/kWh differential, if utilized across 4,200 kWh/year, would yield €762.72/year (4,200 kWh × 18.16c). If only using the second-best plan (SSE Airtricity at 8.58c/kWh), the differential is 15.03c/kWh, which would still yield €631.26/year (4,200 kWh × 15.03c).

There is also a difference in standing charges, the best day-only plan (Energia) has a standing charge of €236.62/year, and the best super off-peak plan (Pinergy) has a standing charge of €283.47/year, so there is a slight cost (€46.85/year) to using the EV super off-peak plan, though this is small enough that I will mostly ignore it in the analysis, I will discount 762 by 46 to get 716, approximately a 6% discount.

So overall, at €0.18/kWh, we discount by 6% to get €0.17. Then €0.17 * 365 days/year, we get €62.05/year of arbitrage.

How much does it cost to get Batteries?

This section analyzes the capital expenditure required to set up a ~15kWh home battery system under different sourcing and assembly scenarios. This should be sufficient for a typical-ish ~12kWh/day average usage in a larger house (4280 kWh/year).

Battery Management System

Approximate cost: €300

We also need a system which takes in the batteries, and makes sure they are all equally charged, and stops current when it is too empty or too full. This is the Battery Management System.

- JBD/Daly Basic: €120-180 - Bluetooth monitoring; 16S compatible (Chinese import)Overkill Solar: €250-350 - Active balancing; data logging (US/China hybrid)Victron SmartShunt: €400-500 - Integration with Victron ecosystem (European)Seplos BMS V4: €350-450 - 2A active balancing; Modbus/CANbus (Chinese premium)JK BMS 200A: €180-240 - Built-in heating; Bluetooth/Wi-Fi (Chinese standard)

I will estimate with a slightly-generous average of €300

Implementation Options (15kWh system)

0. Batteries only

I use the average estimate of €80/kWh for the battery cells. For 15kWh, this is €1,200. This is before you are able to connect it to the grid.

1. DIY Approaches

I found one person who did a full DIY Approach online which was documented. Their approximate spec sheet would look like this if scaled up:

- Battery Cells (PWOD): (16× 320Ah 3.2V cells = 16.3kWh) = €1,294.01BMS (Seplos): €300.00 (With Bluetooth monitoring)Bus Bars & Connectors: €120.00 (Copper nickel-plated)Enclosure/Racking: €250.00 (IP65 rated)Testing Equipment: €80.00 (Multimeter, IR tester)Safety Equipment: €100.00 (Fuses, breakers, isolation switches)TOTAL: €2,144.01 (€131/kWh)

Here are some "DIY Kits" that come with most of the wiring pre-done, but you must supply your own batteries. These are more expensive than manually doing the things oneself, but is cheaper than getting pre-packaged and warrantied rack systems. I have not used any of these sellers, do not take this as an endorsement.

Seplos Mason kit:

- Seplos Maxon 48V 280: €616.02 (Enclosure + BMS)Battery cells: 16x 3.2V 280Ah cells = 14.3kWh (at 80€/kWh approx cost is €1,144)Expansion cables and busbar: €150.00 (For connecting additional cells)Safety Equipment: €100.00 (Fuses, breakers, isolation switches)TOTAL: €2,010.02 / 14.3kWh = €140.07/kWh

Gobel Power:

- Gobel power GP-SR1-KIT: € 627.58Battery cells: 16x 3.2V 280Ah cells = 14.3kWh (at 80€/kWh approx cost is €1,144)Interface cables: €100.00, Notes: RS485/CAN for inverter compatibilityCost: €1,871.58 / 14.3kWh = €130.07/kWh

BASEN Alibaba Kit (15.6kWh, incl shipping):

- BASEN Battery Cells: €913.00 (16× 304Ah cells, 15.6kWh total)BASEN Battery Box + BMS: €481.50 (Enclosure + BMS)Connection Hardware: €100.00 (Cables and connectors)TOTAL: €1,744.50 / 15.6kWh = €111.83/kWhThe also sell a pre-packaged kit for $1700 excl shipping

I will use a slightly conservative estimate of €2000 for 15kWh, or €133/kWh.

2. Pre-built Battery packs

There are a lot of options but I will just use "double DIY" as a rough estimate as it is approximately correct, so like €3,500 or €240/kWh for a 15kWh system. Here are the cheapest examples I could find (note again: no endorsement):

- Fogstar UK 15.5kWh: €3,631 (£3000) (€234/kWh)Pylontech US5000 x3 14.4kWh: €3,450 (€240/kWh)Tewaycell 15kwh: €3075 (€205/kWh)

Most packs seem to be more expensive than this, but these are some reasonable seeming cheaper options I could find.

Hybrid Inverter Options

Approximate cost: €1200

One of the most popular options in ireland seems to be the Solis RHI-5K-48ES-5G which I found being sold for €1,200. With 5kW it should be enough to charge 15kWh within the 3 hours of super off-peak time. If one has solar panels, one likely already has a similar inverter. I do not include cost of installation, which may be significant.

Approximate pay-back period

We compare different usage scenarios to see how the batteries are cycled affects payback time. Since we over-provisioned somewhat, getting 15kwh instead of 12kwh, we shouldn't run out of energy, but we may get a slightly longer payback period.

- Using night rate of 5.8c/kWh vs. day rate of 23.8c/kWh (~17c/kWh spread after standing charges)Annual savings:

- 12kWh daily cycling (4,380kWh annual arbitrage): €745 (4,380kWh × 17c)

| System (Incl inverter purchase) | Total Cost | Cost/kWh | Payback (12kWh/day) |

|---|---|---|---|

| Raw cells only | €2,400 | €160/kWh | 3.2 years |

| DIY Battery Packs | €3,200 | €213/kWh | 4.3 years |

| Pre-built Packs | €4,800 | €320/kWh | 6.4 years |

However, some people may have already installed solar panels, so they may already have an inverter. In this case, the total system cost would include the inverter:

| System (Inverter not needed) | Total Cost | Cost/kWh | Payback (12kWh/day) |

|---|---|---|---|

| Raw cells only | €1,200 | €80/kWh | 1.6 years |

| DIY Battery Packs | €2,000 | €133/kWh | 2.7 years |

| Pre-built Packs | €3,600 | €240/kWh | 4.8 years |

We see that the payback period, even if needing to by an inverter and using (cheaper-end) pre-built packs, is still quite short, only about 6.4 years. The returns are even better if one can use the cheaper DIY battery packs. However, there is also unaccounted for inefficiencies, such as cost of time/labour, imperfect battery cycling, and the fact that the batteries will lose some capacity over time. However, it seems like the returns are still quite good.

Conclusions

I'm pretty surprised. Battery cells have gotten really cheap (€79/kWh is like a medium price), yet there's still a ton of untapped arbitrage potential in both wholesale and residential markets.

Here's what seems to be going on:

- Wholesale markets show potential returns of ~€45/kWh per year just on day-ahead markets (probably more on balancing markets, but I couldn't find good data). With grid-scale installation costs around €150/kWh, we're looking at ~5 year paybacks. That's... actually quite good? But there are caveats with regards to how much capacity could be installed, and how connection to the french grid might affect things.Household economics look even better in some ways - time-of-use arbitrage potential is about €62/kWh per year, with night/day rate differentials around 17c/kWh. Yet most people aren't rushing to install batteries. Possibly because the maximum ROI is capped quite low, being around ~€60/month, though people do often install solar panels and such.Payback periods vary wildly depending on how you implement things - from under 3 years to ~6.5 years (for commercial plug-and-play solutions). I probably am missing something for the commercial cost of installation, it still seems quite viable.

So it seems like there is a lot of room for arbitrage, but it is mostly not being exploited. I think what we're seeing is a market in transition. Battery tech has moved faster than the ecosystem around it, creating this weird gap where the economics should work but the implementation is still catching up. It is possible there are other factors I have missed.

Discuss