If you run a distribution business, you know the drill: A customer rejects an invoice over a purchase order discrepancy, their payment terms reset, and they sit on your working capital while you pay 9%+ interest.

Let’s explore how a mid-sized distributor solved this by scaling their purchase order-sales order verification process before shipping – without adding headcount or disrupting existing workflows.

The real cost of order discrepancies in distribution

Order discrepancies often slip through to post-shipping discovery. It's inevitable when you're processing thousands of orders monthly. But when your customer rejects an invoice because their purchase order (PO) doesn't match your sales order (SO), they're not just creating a headache — they're holding onto your working capital.

For one mid-sized distributor processing 4,000 orders monthly, this meant significant costs and strained accounts receivable cycles. Their accounting team could only manually verify SOs against POs when the value exceeded $10,000, leaving most shipments vulnerable to costly discrepancies.

At current interest rates above 9%, every delayed payment hit hard. Once materials are delivered, customers have zero urgency to fix these issues. Each invoice revision resets payment terms, creating a costly cycle of delays and working capital constraints. Beyond that, these discrepancies could also frustrate customers and potentially lead to the loss of future business.

Why preventing order discrepancies is more complex than it seems

In distribution, matching POs and SOs isn't just about comparing numbers. Your customers might list 10-inch 600-pound stainless steel while you show 10-inch 600# SS. Some send two-page POs, and others send 60 pages with elaborate terms and conditions. Add multiple plant locations, varying payment terms, and lot charge orders — verifying orders before fulfillment becomes increasingly challenging.

The distributor's order processing workflow before automation was typical of many industrial suppliers.

Order discrepancies create costly downstream problems

Beyond the obvious time constraints, manually comparing SOs against POs created several downstream problems that worsened over time.

Here's what was happening:

- Only orders above $10,000 could be manually checked — leaving most orders unverifiedEach manual matching took 30 minutes of senior accounting manager’s timeSmaller orders were shipped without proper verification, carrying hidden risksDiscrepancies surfaced only during invoicing, leading to invoice rejectionsWorking capital and accounts receivable tied up for 60-90 days at ~9.5% interestIssues discovered after shipping when customers had no urgency to fixTechnical part descriptions varied between customers and internal systems (Example: ZP vs zinc plated), complicating manual checksMultiple shipping locations shared zip codes but needed different gate numbers, risking delivery errors and costly reshipments

The time and cost investment was substantial. Let's say the accounting manager is making around $60.44/hour (median hourly wage for the role in the US) — that's a senior talent you're paying to match POs line by line manually. For this distributor, with 734 high-value orders annually and 30 minutes per check, that meant burning through $22,181 just on manual verification. And we're not even counting the hours spent chasing corrections and other additional tasks.

Additionally, the payment clock resets whenever a customer rejects an invoice due to a discrepancy with the PO. So, at 9.5% interest, a 60-day delay on a single $10,000 order cost them $158 in interest alone. Now multiply that across hundreds of orders. Suddenly, those minor verification issues are bleeding tens of thousands in interest costs annually.

The distributor knew they needed to catch PO-SO discrepancies before shipping—when they still had leverage to get issues fixed. But any solution needed to work alongside their existing order processing and fulfillment workflow, not replace it. That's when they approached us at Nanonets.

How we automated PO-SO matching

In this distributor's case, automating order verification required significant change management. While we could automate the entire workflow from order entry to shipping, we knew that would involve retraining the sales team and disrupting established processes.

That's why we began by automating how they verified their sales orders against purchase orders.

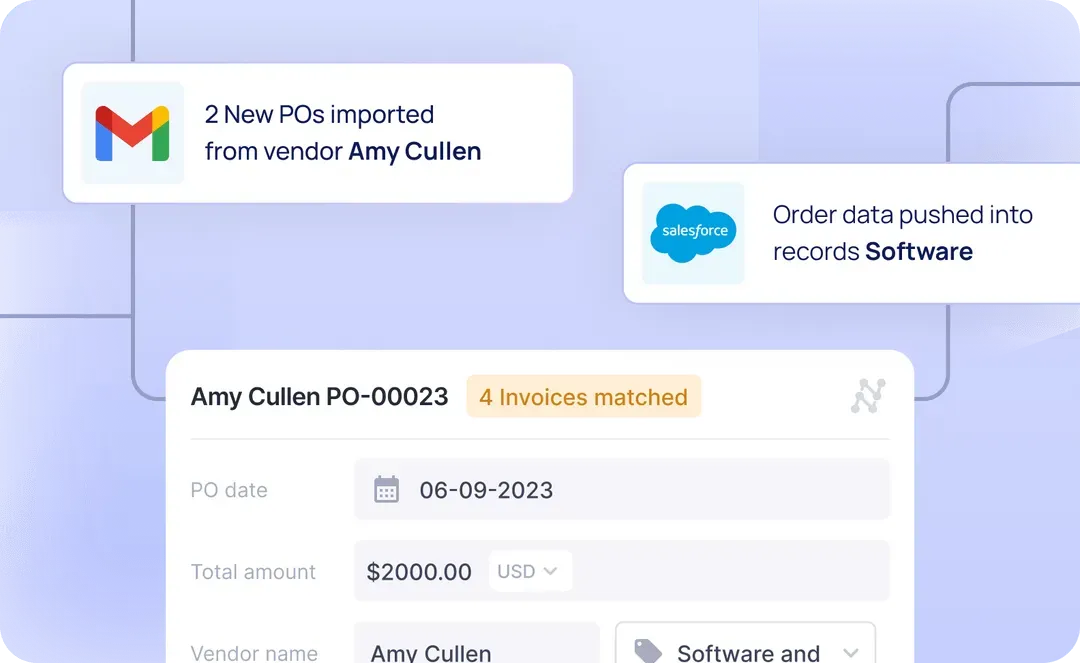

We realized we could deliver immediate value here. Nanonets integrated with the distributor's Business Edge ERP and document management system – streamlining purchase and sales order capture. This way, the sales teams could keep their existing workflow while the automated order matching ran in the background, catching discrepancies before they became costly problems.

Here’s what the workflow looked like:

- Sales team receives purchase order and creates sales order as usualPurchase order gets uploaded to their document management systemOur system automatically detects new purchase ordersSystem pulls corresponding sales order details from Business EdgeSystem verifies sales order details against purchase orderDiscrepancies get flagged before shippingOrder processing team receives alerts for reviewAll verifications get logged for tracking and analysis

The implementation process

Working with the distributor, we took a phased approach. We started with their highest-value orders above $10,000. This allowed them to benchmark our system against their existing manual verification process while minimizing risk. They also categorized their customers based on verification needs — some required exact matches on every field, while others mainly focused on totals and quantities.

We worked with the distributor to train our system to handle these PO-SO variations. This included:

- Handling complex layouts, formats, and emailed ordersManaging multiple plant locationsUnderstanding various product descriptionsProcessing different payment term formats

We set up multiple daily checks during business hours (7:30 AM - 4:30 PM CT). The system periodically checks for new purchase orders, pulls the corresponding sales order details from Business Edge, and runs the verification process — all in the background.

The system then automatically flags issues based on severity:

Critical issues requiring immediate attention:

- Total amount mismatchesPO number discrepanciesPayment term variations

Non-critical issues for review:

- Shipping detail variationsLine item matchesAddress format differences

This new automated workflow helped centralize their verification process, with a dedicated order processing role handling all system alerts. This ensured consistent processing of flagged items and exceptions while maintaining efficiency.

The impact of automated PO-SO matching on order processing

Within 90 days, we helped them achieve a 90% STP (Straight Through Processing) rate — the percentage of orders being verified automatically without any manual intervention — and 90% accuracy in data extraction and matching. This was a significant improvement from the initial 70-75% accuracy rate during early implementation.

The results were transformative:

Operational improvements:

- Easily processing 17-18 files daily through automated order matchingError rates reduced to just 1-2 issues per batch requiring manual reviewAutomated checks running throughout business hours (7:30 AM - 4:30 PM CT)Handle complex distribution scenarios like will-call orders and multiple shipping locations through custom rulesAutomated order matching coverage expanded to all incoming orders – no more $10,000 thresholdEarly PO-SO verification smoothed out downstream 3-way matching processesReduced order cycle time from receipt to shipping

Financial and cash flow impact:

- Order discrepancies caught before shipping — when fixes are easierPayment delays reduced through pre-shipping verificationReduced exposure to 9.5% interest rates on delayed paymentsSenior accounting talent redirected to strategic workBetter working capital management through faster invoice reconciliationInterest costs minimized by preventing 60+ day payment delays

Process improvement:

- Centralized processing through dedicated order processing roleSystem automatically flags issues based on severityReal-time alerts sent to relevant team membersComprehensive tracking through Power BI dashboardsCustom validation rules for specific customer requirementsAutomated exception flagging and reviews replaced manual line-by-line matching

The success led the distributor to create a dedicated order processing position, handling the small percentage of orders that needed human review. This streamlined approach maintained both the high STP rate and accuracy while scaling to handle their full order volume.