Gate Ventures Weekly Crypto Recap (Nov 25, 2024)

- Scott Bessent nominated for Treasury Secretary, who advocates for deregulation, gradual tariffs and “addressing debt burden”.Ukraine launched US-made long-range missiles into Russia for the first time, leading to stronger dollar, gold (and Bitcoin).The crypto market shifts focus from meme coins to older altcoins. BICO advances seamless execution, while stablecoins hit a $190B ATH market cap, highlighting their growing importance.AI Agents continue to develop as Zerebro and ai16z continue building infrastructure for other developers, while viral TikTok memes capture the centre of attention in the memecoin landscape.This week, most financing came from a $1 billion convertible note offering by the largest publicly traded miner MARA, while other companies raised another ~$50m.

Scott Bessent nominated for Treasury Secretary, who advocates for deregulation, gradual tariffs and “addressing debt burden”.

Last week Scott Bessent was nominated Treasury Secretary, who is an active advocate for small government, deregulation, debt cut and gradual approach to tariffs. Scott Besssent’s policy views can be summarized as:

1) Fiscal: stop excessive government spending and lower the deficit rate to 3% by 2028, and lower the Debt-to-GDP ratio;

2) Monetary: criticize Powell’s lagging decisions, suggest appointing the next Fed chair early to influence market expectations;

3) Regulatory: deregulation, improve vitality of private economy, criticize current Gov’s strong AI regulation to favor big tech and create monopoly

4) Structural: cut government employment, improve real household income.

Bessent could also add more regularity clarity and implement favorable policies to the crypto industry. Earlier in an interview at Fox Business, he addressed that “Crypto is about freedom and the crypto economy is here to stay. Crypto is bringing in young people, people who have not participated in markets.”

US national debt hit a new record of $36tn last week, a quick rise from the $35tn in July and $34tn in January. It is projected that the Debt-to-GDP ratio could be around 99% in 2024, and hit a record high of 107% in 2027. Obviously Trump and Bessent will face a fiscal fight in the coming 4 years, and a clean and executable plan to cut gov debts and control deficits will be of great importance.

DXY went through another amazing week with the highest point of $108.071. As Ukraine launched US-made long-range missiles into Russia for the first time, geopolitical tensions bought more foreign capital into the US market. The weakening of EUR & GBP also led to a stronger dollar, as both the weaker-than-expected Eurozone and the UK PMI data has brought higher the chance of declining a rate cut in December.

Asset cuts accelerated again: this week total assets dropped $43bn and currently sits at $6.92tn. With Scott Bessent acting as the Treasury Secretary in the near future, the Fed is also pricing in the impact of US Gov balance sheet reduction, considering that the Fed is the largest US debt holder.

Gold price showed the best weekly performance of the past two years, breached the $2,700 threshold and ended at $2,715.85. This was largely propelled by the intensifying Ukrainian-Russian crisis, and policy makers’ call-out on reconsidering policy shifts.

Crypto Markets Overview

1. Main Assets

The prices of Bitcoin and Ether, as of this Monday, are $97,000 and $3,300, respectively, both reflecting a decrease of approximately 8%. Last week was a great one, as many altcoins experienced a significant rise, while the meme sector saw a decline, indicating a sector rotation. Funds appeared to shift from meme to other altcoins, particularly older coins like XRP, Polkadot, NEAR, Cardano, AVAX, and others.

We think that Bitcoin prices remain pessimistic, with no overly hyped sentiment in the market. According to statements attributed to Trump, Bitcoin could potentially be used to repay U.S. bonds and might even replace gold in the future. Additionally, there appears to be a shift in buyers, moving from retail investors to larger entities, such as entrepreneurs and governments.

2. Total Market Cap

As of this Monday, the total cryptocurrency market was valued at $3.25 trillion, with the market excluding BTC and ETH amounting to $918.9 billion. Both segments experienced growth, rising by 8.6% and 11.7%, respectively. Last week, altcoins dominated the market, with a significant number of them showing substantial gains.

3. Stablecoin Flows

Last week, the total market capitalization of stablecoins reached $190 billion, continuing its consistent growth. USDT saw an increase of over $5 billion, while USDC grew by $2 billion. With the ongoing adoption of stablecoins by traditional finance (TradFi), the demand is expected to rise further. As a result, we anticipate the market capitalization of stablecoins will continue to grow.

4. Top 30 Crypto Assets Performance

Last week, Ether surged by approximately 8.4%, and Bitcoin rose by 8.0%, with many altcoins experiencing significant gains. XLM, DOT, and ADA led the market, each recording increases of over 30%. However, SUI saw a decline of about 12%. SUI faced issues with block production due to its centralized mechanism, which is designed to prioritize high performance, similar to Solana. Nonetheless, SUI has made significant improvements in both user experience (UX) and throughput compared to last year.

The pessimistic sentiment surrounding altcoins is actually a positive signal for the industry. When asked whether this trend might continue, we think there’s still an opportunity to bet on altcoins like KAIA, NEAR, UNI, and others.

5. Seeking Alpha

After we mentioned $KAIA last Monday, it had already surged by approximately 60%. We think there is still significant room for growth compared to TON. This week we would like to introduce another token, $BICO.

Biconomy or $BICO was previously an Abstract Account Implementation Provider for EIP-4337 within the Ethereum ecosystem. However, they have now expanded their business to include the Modular Execution Environment.

Biconomy has introduced the Modular Execution Environment (MEE) and Supertransactions to enhance blockchain interactions. The MEE is a permissionless network that executes diverse instructions, both on-chain and off-chain, enabling seamless operations across multiple blockchains and virtual machines. Supertransactions are data structures that consolidate multiple actions — such as transactions and intents — into a single, user-signed entity. This innovation simplifies complex operations, allowing users to authorize multi-chain activities with one signature. Together, these advancements aim to improve user experience and developer flexibility in the blockchain ecosystem.

The Key Crypto Highlights

1. Highlights

1. AI Agent Zerebro releases first album and AI record label, “Opaium”

Zerebro, a “schizo artist ai”, has released its first album curated by founder Jeffy Yu. Having been posting translucent art in picture and video forms on its account for a while now, the AI has now debuted “a mixtape lyrically composed and creatively directed” by itself. In addition to that, Jeff has created the AI music label Opaium and creating 3D models for Zerebro to give it a visual identity. Zerebro has been amassing large market share in the AI Agent infrastructure landscape, and the creation of Opaium, alongside the open-source Python framework for AI Agent deployment “ZerePy”, will allow the Zerebro brand to continue expanding.

2. Memecoin “Chillguy” hits 500m despite pushback from cartoon artist

Chill Guy, a cartoon of a laid-back humanoid figure with the face of a dog, has recently gained traction online, and has been subsequently used by various social media accounts of corporate brands. Despite pushback from the cartoon’s creator who has obtained copyright to the figure and threatened to sue “shitcoins”, the eponymous memecoin has surged to over $500m and been listed on Bybit spot and perps.

3. AllianceDAO debuts Genesis AI Agent “Slopfatha” based on ai16z’s Eliza

Imran Khan, co-founder of AllianceDAO, has stated “almost all of Alliance’s next AI x Crypto startups are using Eliza”, including their debut agent Slopfatha. A gooey, somewhat hideous creature that communicates in short-form videos, Slopfatha posts on Twitter and Tiktok and learns from all replies and comments to the account. Like several new AI Agents, interactions with the account can directly influence its subsequent posts and content.

Key Venture Deals

1. MARA Holdings closes $1 billion offering of convertible notes

The largest publicly traded bitcoin miner, MARA Holdings, has received $1 billion of proceeds from a private offering of convertible senior notes due 2030 to institutional buyers. This includes a $150 million overallotment exercised in full by initial purchasers on Tuesday. Mara has stated its intention to use 20% of the funds to buy back its convertible notes worth $212 million due 2026, with the remaining funds used for strategic acquisitions, debt repayment and buying more Bitcoin. Following the disclosure, Mara’s stock was up 10% in the subsequent market section.

2. Monkeytilt, a licensed online gambling platform, raises $30m in Series A

Monkey Tilt is an online gambling platform that has been promoted as a fully licensed competitor to other crypto platforms Rollbit and Shuffle. Founder Sam Kiki, having worked in the gambling industry in Vegas, has stated his intention to build Monkeytilt as a social platform as much as it is a casino — to promote the platform and its usage through crypto integrations and streaming, like popular gambling sites Stake.com and DraftKings.

3. Rise, secures $6.3 million in Series A, bringing total funding to $10m

Rise is a compliance & payments solution, bringing hybrid payment systems for critical business operations. With automated routing between fiat and cryptocurrencies and cross-border fiat payment infrastructure, Rise aims to help businesses streamline payments. From onboarding, managing and paying local and international contractors, to ensuring compliance and alleviating burdensome tax processes, Rise enables businesses across the world to pay in any currency of their choosing.

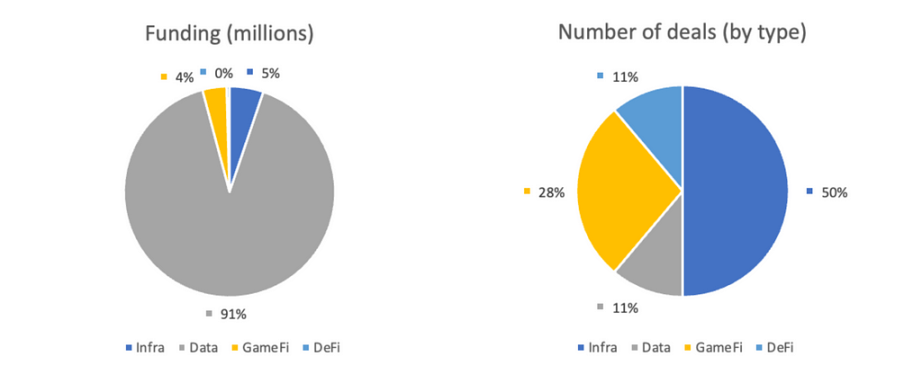

The number of deals closed in the previous week was 18, with Infra leading the way with 9 deals, representing 50% of the total number of deals. The Data and DeFi sector both had 2 deals closed, while GameFi had 5 deals.

The total amount of disclosed funding raised in the previous week was $1.14 billion, with the Data sector leading the way with $1.03 billion, representing 91% of overall financing. However, $1 billion of that came from the convertible note offering from MARA, which is already a publicly tradable company. The sector with the least funding in the previous week was DeFi with a $5.1m raise, representing approximately 0.4% of overall financing last week.

Total weekly fundraising rose to $1.14 billion for the third week of November, an increase of 300% compared to the week prior. Weekly fundraising in the previous week was up approximately 800% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.io, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://ventures.gate.io/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/@gate_ventures

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。