Telegram and TON: Next-Generation Web3 Traffic Gateway

On September 13, 2023, Telegram officially launched the native, embedded TON Space and announced its integration with the TON blockchain ecosystem. This new self-custodial wallet feature is directly integrated into the Telegram app, allowing its 800 million active users to conveniently manage digital assets on the platform. As a result, the number of on-chain wallets on the TON blockchain skyrocketed to over 100 million, making it the fastest blockchain in history to reach this milestone from the start of the year to October.

Telegram’s integration strategy aims to convert its massive user base into active participants in the TON ecosystem. By introducing innovations such as gas-free transactions, social finance, NFTs, and Mini Apps, Telegram is building a more diverse, decentralized social platform. Through this approach, Telegram incorporates blockchain technology into its core services, offering new types of social and financial interactions, thereby enhancing user engagement and ecosystem value.

Our analysis of Telegram’s traffic sources from October 2023 to October 2024 reveals that approximately 25.9% of traffic primarily originates from Russia, aligning closely with the strong presence of Russian project teams within the TON ecosystem. For instance, Russian market makers like Gotbit have considerable influence within TON. However, this concentration also suggests that TON may face heightened regulatory scrutiny from Western jurisdictions. Other high-traffic countries include India and Brazil, with 450 million and 340 million visits, respectively. After deduplication, the U.S. ranks third in unique visits, also contributing substantial traffic.

Supported by Telegram’s extensive user base, TON has seen explosive monthly active user (MAU) growth since the TON Foundation took over its development. According to Hamster Kombat, TON currently has around 240 million users (25% of Telegram’s MAUs). Numerous lightweight applications (TAMs) have attracted significant user interest, contributing to remarkable wealth creation. Applications like DOGS, NOT, Catizen, Rocky Rabbit, and Blum each boast over 20 million users, while many projects have user counts in the millions. This vast pool of traffic could provide a vital boost for the Web3 ecosystem, currently challenged by a limited user base.

Product Details

Product

Architectural Overview

Telegram Mini Apps (TMA) are products similar to WeChat mini-programs and are developed within the Telegram ecosystem. Many developers attempt to combine them with the TON blockchain to build Web2.5 internet products. TMA are developed based on web technology, allowing users to access TMA on all devices. However, interactions with the TON blockchain require using TON’s dedicated language, FunC, and running it via the TON Virtual Machine (TVM), which generates Fift assembly code. TVM itself is implemented in C++.

The TON blockchain uses a sharded blockchain architecture, structured in four layers. In theory, TON can support up to ²³² workchains running in parallel, with each workchain set up with its unique operational rules according to specific application or transaction requirements. Each workchain can further be divided into up to ²⁶⁰ shardchains (or sharding chains). Currently, however, only one shardchain, known as the Basechain, is running on TON.

In this architecture, the Masterchain serves as the storage chain for the final states of all workchains. It stores the protocol’s core information, including validator details, and maintains the latest block hash records of all workchains and shardchains to achieve consensus across the entire network. Shardchains are similar to sharded databases and support load balancing, meaning a database or workchain can automatically split into multiple workchains to enable higher concurrency.

Regarding the account model, although it is called an account chain, this only indicates that transactions are executed sequentially (Tx1 -> Tx2 -> Tx3 -> …). Accounts do not exist as chains; they are essentially based on the Actor model, widely used across multiple blockchains, including the derivative Sui Objective model, Polygon Miden, and Arweave AO. However, it’s worth noting that TON’s architecture remains relatively simple at present. Although sharding chains are designed and conceptualized, TON still operates as a single-chain system.

Features

Actor Model

In TON, the fundamental unit is the Actor, which can be understood similarly to smart contracts in Ethereum. Both accounts and smart contracts are considered Actors. The Actor model was proposed by Carl Hewitt in 1973 to address the complexity of shared states in traditional concurrent programming through message passing. Each Actor possesses an independent state and behavior, without sharing any state information with other Actors. An Actor has logical execution and data storage capabilities, executing the following steps in each transaction:

- Triggering Event: Typically, an Actor receives a message.Processing: The Actor processes the event by executing its code within the TON Virtual Machine, based on its attributes.State Modification: The Actor updates its own attributes (code, data, etc.).Message Generation (optional): The Actor may generate and send a message.Standby Mode: The Actor then enters standby mode until the next event occurs.

This combination of steps constitutes a single transaction. Each transaction is processed independently and in parallel, allowing Actors to interact by asynchronously sending messages to each other, enabling concurrency among Actors.

Jetton

In TON, tokens are called Jettons, and each Jetton is also a type of Actor. A user’s wallet Actor does not directly store Jetton balances. For instance, in the case of a meme token called Gate Token, deploying a Mint contract (Jetton) creates the Gate Token. If a user wants to hold Gate Token, a new Actor is generated containing the Gate Token mint contract address, balance information, and holder’s address. If 100,000 users want to hold Gate Token, this will result in 100,000 separate Actors.

These Actors are theoretically located on a single shardchain, but if a large number of holders initiate asset operations with the Gate Token Actor, sharding can be applied. The Actor model, with its independent states, enables parallel execution, enhancing scalability.

In summary, we register an Actor wallet on-chain with a TON account balance, but we do not store the balances of other tokens (Jettons). Other tokens also exist in the form of Actors, with each having a Holder Address. Interactions between Actors are facilitated through message passing, allowing interoperability.

Development language

There are three programming languages available on TON: Fift, FunC, and Tact.

- FunC: A low-level language similar to Lisp, FunC is the primary programming language for TON smart contracts. It emphasizes efficiency and flexibility, allowing developers to directly manipulate memory and manage resources in detail. However, due to its low-level nature, developers must manually handle memory management and low-level operations, requiring strong programming skills and a keen awareness of security. Improper handling may lead to issues like memory leaks or buffer overflows, posing potential security risks to smart contracts.Tact: A higher-level language, Tact offers more abstract features but comes with greater complexity and a higher programming difficulty.Fift: A low-level assembly and debugging language, Fift allows direct interaction with the TON Virtual Machine, making it suitable for low-level debugging and testing of smart contracts. However, Fift is still in an early stage, with limited tooling and documentation. Similar to the evolution in traditional development, most engineers transition from low-level languages (like C, similar to FunC) to higher-level languages (like C++, JavaScript, Java, and Rust).

Team

Developers Anatoliy Makosov and EmelyanenkoK initiated the Newton open-source community to further promote TON’s open-source development. The Newton team later rebranded as the TON Foundation. Currently, the TON Foundation operates as a non-profit community, attracting over 40 independent, unregistered developers from various regions and is supported through donations.

Pavel Durov is the founder and CEO of Telegram. Launched in 2013, Telegram attracted over 60 million active users within two years. Prior to creating Telegram, Pavel founded VK, a popular social network in Russia and several other countries, with over 100 million active users. In early 2014, Pavel left Russia and VK to focus on developing Telegram.

Steve Yun is the current president of the TON Foundation. He holds a Bachelor’s degree in International Studies from Simon Fraser University and a Bachelor’s degree in Business Administration from Douglas College. Steve has held key positions in various organizations and has played a significant role in the TON Foundation since 2018, progressing from a strategic contributor to a founding member and finally to president in 2023. Before this role, he served as COO at Koinvestor, overseeing the financing of nine crypto projects, raising a total of $50 million, and leading strategic partnerships.

Dima D is the technical lead of the TON Foundation. He holds associate degrees from the Moscow Aviation Institute and Moscow State Technical University and a Bachelor’s degree in Computer Science from the University of London. Dima previously worked as an engineer at Stealth, ivi.ru, and The Open Platform. He joined the TON Foundation as a product lead in September 2022 and was promoted to technical lead in August 2023.

Fundraising

The initial TON token was named GRAM and was issued through an ICO. From January to March 2018, it went through multiple rounds of closed ICOs. The first stage was limited to trusted individuals and internal company members. The second stage was a public fundraising round (with a minimum subscription of $1 million), aiming to raise $850 million but ultimately raising $1.7 billion. The third round was canceled due to oversubscription. However, in June 2020, under pressure from a U.S. court, it was announced that ICO funds would be returned. Only 72% (approximately $1.22 billion) could be refunded immediately, with an option to refund 110% a year later.

Ecosystem

Current Status

Community

User Community

Developer Community

The development of the TON libraries remains active and stable, with an average of around 10 commits per day. The core team of developers consistently submits code, actively addressing issues and conducting reviews, ensuring steady progress and maintenance across the ecosystem.

The growing attention on the TON ecosystem, coupled with increased developer participation, has led to a sharp rise in the number of issues in the codebase. However, the developer count may still be insufficient to fully meet the demand, indicating a potential shortage in development resources.

Given TON’s use of a unique development language and virtual machine, the number of specialized developers remains relatively low. Many on-chain projects choose to outsource development, but overall, TON’s developer ecosystem is still in its early stages, with considerable potential for future growth.

Ecosystem Landscape

In the development of the TON ecosystem, the first significant trend has been an explosion of applications, particularly those with diverse, consumer-oriented offerings — an area currently lacking in the broader industry. Presently, TON’s most popular applications are low-barrier “tap-to-earn” mini-games that have accumulated a substantial user base, showcasing the platform’s potential. Taking WeChat as an example, the top ten mini-apps by monthly active users (MAU) are all consumer applications, proving that consumer-grade apps are in high demand and hold long-term growth potential. As a first step, productivity tools targeting consumers could be a promising entry point for experimentation.

Next, we will provide a category-by-category overview of the development status and potential opportunities within the TON ecosystem.

Utilities

GameFi

Currently, JetTON Games, a gambling-type game, has the highest monthly active users (MAU) on TON, reaching 4.3 million. Its primary model involves users collecting tickets through mini-games like “Fruit Ninja”-style slicing games, task platforms, and in-app purchases. These tickets allow users to compete for a share of the prize pool.

Among non-gambling games, Rocky Rabbit is currently the most popular, with 8.7 million subscribers on its channel. However, its gameplay remains relatively simple, typically combining casual gaming with a task platform and in-app purchases.

We also observed that the popularity of most projects is primarily driven by airdrop expectations. Once the airdrop ends, user metrics tend to drop significantly.

Take Catizen as an example. Analysis of its website, Catizen.ai, and X page data shows that traffic peaked in June and July, driven by two funding announcements from the team during those months. Binance announced its lead investment in the strategic round in July, further boosting Catizen’s numbers to new highs, reaching 585,218 daily active users (DAU) and 8,914,877 channel subscribers.

However, after the airdrop announcement on September 14, traffic dropped sharply, falling from 260,000 daily visits to 36,000 — a decline of 86%, with a retention rate of only 14%. A similar pattern occurred with Hamster Kombat’s Token Generation Event (TGE) on September 26, where website visit retention was only 7%. These retention figures indicate that quality improvements in Telegram Mini Apps (TMA) could significantly enhance user retention. Despite substantial declines, the large initial user base has allowed these projects to maintain a notable number of users.

Consumer Dapps

Products like Play Wallet and Solo even have Russian set as the default language. Play Wallet offers fiat on-off ramp services through third-party partnerships, while Solo supports crypto-based top-ups for mobile phone cards worldwide. However, as H5 web applications (WebAPPs), their user experience (UX) is still somewhat lacking in smoothness. Additionally, these applications have relatively low monthly active users (MAU), indicating a need for further exploration of product-market fit (PMF).

Among NFT trading platforms built on TON, the largest, Ton Diamond, has a weekly trading volume of only about $1.8 million, indicating relatively weak liquidity. However, as an ecosystem centered around the social platform Telegram, there is significant potential for content to be tokenized as NFTs, especially given the natural fit of NFTs for identity-related attributes. Therefore, we remain optimistic about the future of the NFT ecosystem on TON.

TON Dating is currently one of the most popular social products, exemplifying Web2.5 products that align closely with user needs and offer practical utility. In the past month, TON Dating reached a monthly active user count (MAU) of 361,826. Another social application, WhoWhere, also exhibits characteristics of early Web2 products but lacks a refined user experience and sufficient user volume, making it challenging to build meaningful social stickiness.

DeFi

The DeFi ecosystem on TON remains a weak point, largely due to the limited adoption of the FunC programming language and the requirement for developers to familiarize themselves with the fully native TonVM. These factors present barriers to entry, slowing the growth and robustness of DeFi on the platform.

On TON, there are only eight ecosystem projects with a total value locked (TVL) exceeding $10 million.

TON Stat has tracked the daily trading volume of two major DEXs on the platform. After an initial surge due to the TON chain’s token issuance and wealth effect, DEX trading volumes have since declined.

Stablecoins

The transfer fees on TON are around $0.1 to $0.2, which aligns well with consumer needs on a social platform with 900 million monthly active users. Consumer finance scenarios, such as stablecoin transfers, are crucial for expanding its applications. In traditional social software, financial lending is a key method for converting user traffic, and on-chain low-interest DeFi and stablecoins (like USDT) enhance this appeal.

Currently, USDT is the primary stablecoin used in the TON ecosystem, experiencing rapid growth from $9.4 billion in May to $7.68 billion in October, with a monthly compound growth rate of 62.23%. If blockchain technology demonstrates product-market fit (PMF) in consumer contexts, TON’s DeFi system could hold substantial potential for growth and further development.

On-chain Statistics

The number of wallets on TON experienced explosive growth over six months, surpassing 100 million. However, multiple data points indicate that the initial growth momentum in the ecosystem is beginning to slow, as seen in monthly and daily active user metrics. The first wave of ecosystem growth was driven primarily by simple “tap-to-earn” games, but retention and conversion rates suggest that this straightforward approach has already reached most accessible users. To engage the remaining users, more refined products will be necessary to unlock further growth.

Overall, retention rates on TON remain very low. For instance, Catizen has only a 14% retention rate, and purely tap-to-earn games like Hamster retain just 7%. However, improvements to app content have demonstrated a significant positive impact on retention. The ecosystem’s main business model currently relies on airdrops to attract users, using a primary game to drive engagement, supplemented by task systems to funnel users toward other applications and in-app purchases. UX remains suboptimal, token prices are difficult to sustain post-launch, gameplay is often repetitive, and monetization methods are rigid. Traffic surges are more accidental than systematic, as new products or retention measures are often not introduced promptly post-token issuance to enhance user stickiness and enable re-engagement.

Currently, aside from the rapid development of GameFi, other sectors within the TON ecosystem remain in very early stages. In DeFi, only 8 projects have surpassed the $10 million mark, and consumer applications are also in initial phases with relatively weak infrastructure. Most projects have yet to find product-market fit (PMF), reflecting both current limitations and future potential within the ecosystem. As the initial “earn-by-participating” growth model reaches its limits, the focus will shift to converting the remaining 75% of off-chain users to on-chain users and retaining the current 25% base. Achieving this will depend on refined ecosystem operations and discovering genuine PMF for blockchain technology in consumer applications.

Future

TON has outlined a roadmap on its website, with several initiatives progressing in parallel. Among these, three stand out as strategically significant for TON’s future:

- Gas-Free Transactions: This is one of the most intriguing milestones in TON’s 2024 roadmap. No other major blockchain currently offers gas-free transactions, which could position TON as a disruptive force in the blockchain space, attracting users from other ecosystems. Typically, users on blockchains must pay gas fees for transactions, which act as a deterrent against spam transactions that could clog the network. TON may choose to subsidize gas fees in specific cases (e.g., Telegram wallet or USDT transfers) to encourage daily use on the platform.Technical and User Expansion: TON aims to attract 500 million Telegram users by 2028, leveraging sharding technology to ensure ample transaction processing capacity and keep transaction costs low.Stablecoin Toolkit: Supporting consumer finance, the Stablecoin Toolkit will enable developers to build native stablecoin transfer services and create financial services based on stablecoins, facilitating a range of applications in consumer finance on the TON ecosystem.

Tokenomics

Distribution

From July 2020 to June 2022, TON initially operated on a Proof-of-Work (PoW) mechanism, with an initial token supply set at 5 billion TON. Of this, 72.5 million TON (1.45%) were allocated to the team, while the remaining 4.9275 billion TON (98.55%) were pre-mined. Reports indicate that addresses associated with the TON Foundation mined approximately 85% of the tokens. Notably, a community vote in 2023 decided to freeze inactive accounts for four years, impacting around 20% of the token supply.

The TON Believers Fund was launched through a smart contract, allowing TON holders to lock tokens for five years, with a two-year cliff followed by a three-year linear release. The deposit period concluded on October 23, 2023, resulting in a total of approximately 1.033 billion TON locked, with an additional 284 million in rewards, amounting to roughly 1.317 billion TON locked for two years. Starting October 12, 2025, approximately 37 million TON will be unlocked every 30 days over 36 installments, gradually adding to the circulating supply. These two locking events have collectively reduced TON’s total circulating supply by around 2.3 billion tokens.

Currently, TON’s issuance rate is approximately 1% per year. As of September 9, 2024, the total supply is around 5,112,895,953 TON. According to CoinMarketCap data, the circulating TON supply stands at 2,536,837,448 tokens, with a market capitalization of $12.8 billion and a fully diluted valuation (FDV) of $25.7 billion.

As of October 9, 2024, according to StakingRewards, a total of 657.4 million TONcoin are staked.

According to Tonstat, TON has 616.6 million tokens in traditional staking and 62.3 million in liquid staking. Comparing this with the growth of Liquid Staking Tokens (LSTs) on other chains, TON’s staking ratio still has considerable room to increase. Using Ethereum’s relatively low staking ratio (28%) as a benchmark, TON’s staking ratio has up to 220% growth potential. If liquid staking reaches 45% of the total staked amount, then Liquid Staking Derivatives (LSDs) on TON could still expand by approximately 445%.

Gas Fees

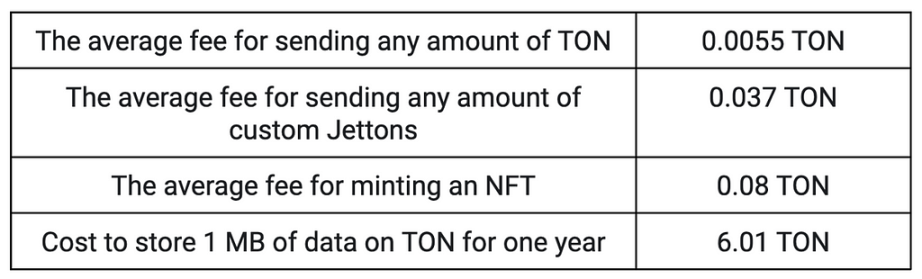

Fees on TON are challenging to estimate in advance, as they depend on various factors such as transaction runtime, account status, message content and size, blockchain network settings, and many other variables that cannot be determined prior to sending the transaction.

Recently, TON’s metrics have shown some decline; however, even at a daily fee of 13,389 TON, the annual fee revenue would be approximately 5 million TON, translating to around $25 million. In comparison, Solana’s Jito fee revenue reaches about $200 million annually, while Ethereum’s yearly fee revenue stands at $660 million. This highlights TON’s potential for growth in transaction fee revenue as its ecosystem expands.

On-chain Addresses

TON’s on-chain token holdings are highly concentrated. As mentioned in the token allocation section, approximately 85% of early mining addresses are associated with the TON Foundation.

Leveraging Telegram’s vast user base, TON has seen substantial growth in monthly active users (MAUs) since the TON Foundation took over development. According to Hamster Kombat data, TON currently has around 240 million users (about 25% of Telegram’s MAUs), yet on-chain MAUs peak at only around 12 million, reflecting a conversion rate of just 5% from Telegram to TON chain users. This low conversion rate also points to a significant untapped opportunity. We believe that the main barriers to converting Telegram users (TMA) to on-chain users include an unsatisfactory wallet user experience (UX) and a lack of blockchain knowledge among users.

Currently, there are around 90.4 million token holders on the chain, but after rapid growth from May to October, the pace has noticeably slowed. Hamster has nearly reached most of the potential conversion audience. Moving forward, unlocking the remaining 75% of Telegram’s users and converting more on-chain active users from the existing 25% will require more realistic, relatable application scenarios that align closely with everyday needs.

Insights from the Integration of Telegram and the TON Blockchain

The integration of Telegram with the TON blockchain offers profound insights, expanding the functional boundaries of social platforms and presenting new development pathways for applications like WeChat, LINE, and others. Firstly, with a large user base, social platforms can rapidly promote blockchain technology, lowering entry barriers to digital assets and strengthening user engagement. Secondly, by building a rich ecosystem of decentralized applications (dApps), these platforms can offer a diversified service experience that attracts more developers, fostering a self-sustaining ecosystem. In particular, within the decentralized finance (DeFi) ecosystem, blockchain technology enhances transparency, lowers user entry barriers, and reduces intermediary costs.

For platforms with large user bases, such as WeChat, LINE, and Facebook, innovations in on-chain business models — ranging from decentralized digital asset transactions to financial and social value applications — can open new revenue streams and growth opportunities. In regions where token issuance is legal, these utility tokens, which differ from traditional equity, can benefit from global liquidity, significantly boosting corporate revenue and profitability.

However, the integration of TON and Telegram still faces core challenges related to blockchain technology and industry development. Despite incentives like “on-chain rewards,” the on-chain adoption rate among Telegram users is only 25%, with 75% of users still off-chain. Among the 25% on-chain users, we estimate that retention rates for simple Tap-to-Earn applications are only around 10%. The first wave of growth and wealth effects in the TON ecosystem is nearing its end, with the next priority being to effectively convert these on-chain and high-traffic application users and engage the remaining 75% of Telegram users with products that demonstrate genuine product-market fit (PMF).

In summary, data shows that TON’s initial growth phase is reaching its conclusion, with key metrics showing a downward trend. Nonetheless, with Telegram’s vast user base and plans to onboard 800 million users, many opportunities remain. For instance, the lack of foundational infrastructure in the Telegram ecosystem, the relatively low daily active users (DAU) in non-GameFi sectors, total value locked (TVL), and trading volume all highlight potential growth areas outside the gaming sector. TON’s potential remains strong, particularly in the fields of stablecoins and consumer finance, where official support could drive success, enabling Telegram’s 900 million monthly users to access low-cost, accessible financial services. In this process, however, the on-off ramp for inclusive finance, wallet UX, and the infrastructure’s concurrent capacity will be crucial areas for further development.

References

《TON blockchain: a group of related whales mined 85% of TON supply》

《TON Tokenomics: An Overview》

《How to shard your TON smart contract and why — studying the anatomy of TON’s Jettons》

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.io, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://ventures.gate.io/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/@gate_ventures

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。