来源:雪球App,作者: 王冠亚,(https://xueqiu.com/4525540121/310878775)

巴菲特致股东的信原文精读Day513:

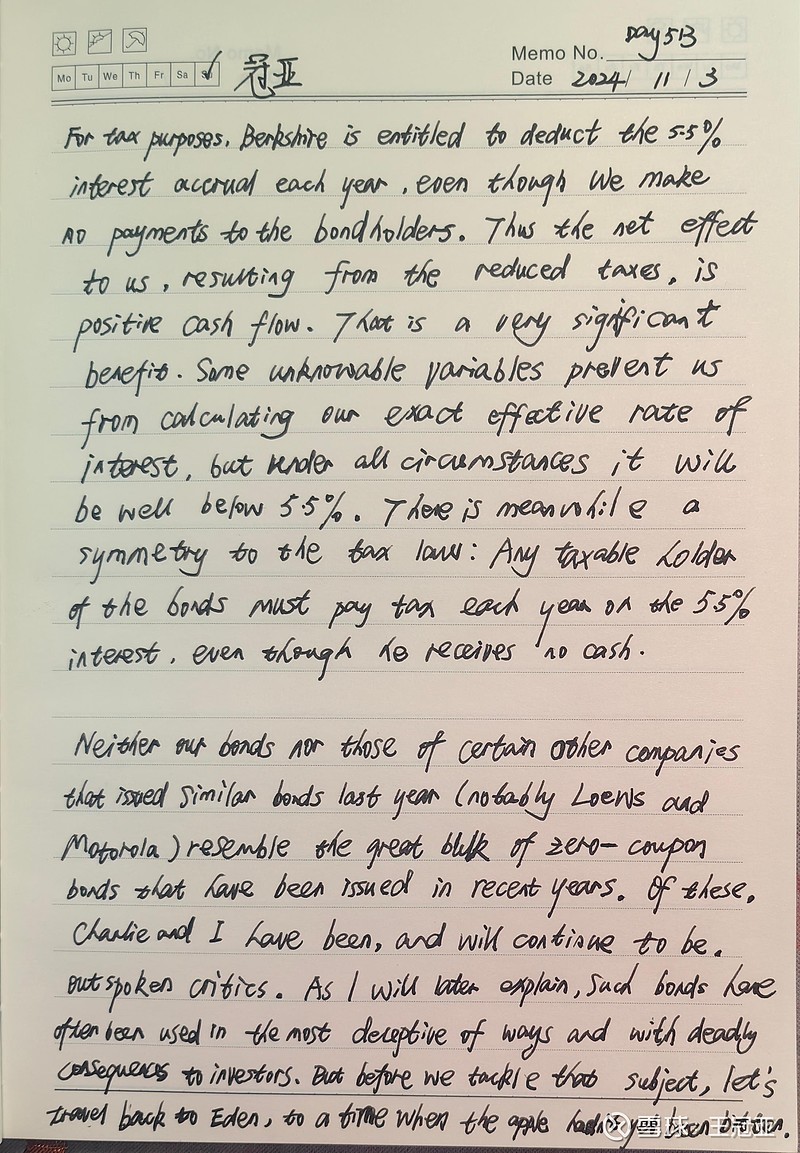

原文:For tax purposes, Berkshire is entitled to deduct the 5.5% interest accrual each year, even though we make no payments to the bondholders. Thus the net effect to us, resulting from the reduced taxes, is positive cash flow. That is a very significant benefit. Some unknowable variables prevent us from calculating our exact effective rate of interest, but under all circumstances it will be well below 5.5%. There is meanwhile a symmetry to the tax law: Any taxable holder of the bonds must pay tax each year on the 5.5% interest, even though he receives no cash.

Neither our bonds nor those of certain other companies that issued similar bonds last year (notably Loews and Motorola) resemble the great bulk of zero-coupon bonds that have been issued in recent years. Of these, Charlie and I have been, and will continue to be, outspoken critics. As I will later explain, such bonds have often been used in the most deceptive of ways and with deadly consequences to investors. But before we tackle that subject, let’s travel back to Eden, to a time when the apple had not yet been bitten.(1989)

释义:1.“accrual”意为“应计的”;

2.“symmetry”意为“对称”;

3.“bulk”意为“大批”;

4.“outspoken”意为“直言不讳的”;

5.“deceptive”意为“骗人的”。

精译:就税负来说,虽然伯克希尔没有向债券持有人支付利息,但我们有权按照每年5.5%的应计利息抵税。因此,我们减轻了税负,也带来了正向的现金流。这是一项非常重要的好处。由于存在一些不可知的变量,我们无法计算出准确的实际利率,但在任何情况下,它都将远低于5.5%。与此同时,税法存在一种对称性:即使债券持有人没有收到现金,也必须每年为5.5%的利息纳税。

无论是我们的债券,还是去年某些公司(尤其是洛斯保险和摩托罗拉)发行的类似债券,都与近年来发行的大部分零息债券大不相同。对于占据主流的零息债券,我和芒格向来是直言不讳的批评者,将来也会如此。此类债券常常极具欺骗性,并对投资者造成致命的伤害,稍后我们会详细说明。但在我们讨论这个话题之前,让我们回到伊甸园,回到人类尚未偷吃禁果的时代。(1989年)

心得:伊甸园,是地上的乐园,根据《圣经·旧约·创世纪》记载,耶和华照着自己的形象创造了人类的祖先,也就是男人亚当,再用亚当的一根肋骨创造了女人夏娃,并安置这对男女住在伊甸园,后世以此来比喻幸福美好的生活环境。

手抄:

朗读:大家请自由发挥,哈哈哈!大家的手抄原文,也可以在评论区上传打卡。