There is a lot of discussion of whether building “a mere wrapper on top of GPT” is defensible.

In this post I argue most SaaS software starts off default non-defensible (hence all the HackerNews posts & Reddit threads saying as much), and tend to build a moat over time. In parallel this post delves into different forms of moats as well as competition more generally.

Most early stage startups are not very defensible

Many tech startups will launch an early product within 6-12 months of founding. Teams will initially be 2-5 people with a mix of eng/product/other. Definitionally, it is easy to copy or clone something that has taken a handful of people a handful of months to build.

There are of course counterexamples to this - either in terms of it taking longer to build a technically challenging more defensible product (see eg Snowflake), or there are considerations around IP (for biotech), deals (e.g. payments needing a backend), regulation (“we need to be a broker/dealer first”), talent (“there are 20 people on the planet who can train this sort of foundation model”) or other areas (for example, pre-existing open source software that is being commercialized by the team who created it).

However, the vast majority of SaaS, consumer, and certain types of AI companies are easily and rapidly cloneable. Yet many massive companies have been formed in areas that a priori may be easy to copy or build.

Adding defensibility over time

While a handful of startups start off with defensibility intact, the vast majority do not and need to add defensibility over time. There are a few forms of defensibility that tend to emerge:

Network effect. In network effects every user creates more value for other users, forming a positive feedback loop. Network effects can be local (e.g. the more people who use Slack within a company the more benefit) or global (the more people on Instagram, the more people engage across networks and geos). Few SaaS companies have true network effects, with companies like Github as a potential counter example. Uber had a network effect and positive feedback loop between driver and rider liquidity in a given city. Network effects are one of the few forms of defensibility that can arise immediately upon launch of a company.

Platform effect. Some SaaS or operating system companies benefit from a platform effect. For example, Salesforce is a sticky product because so many other companies have integrated against it. Platforms usually come after a company has been in existence for a few years and has enough users that others want to build against its platform to reach said users.

Integrations. Related to platform effects, sometimes a company becomes defensible via integrations. Integrations may include:

The company integrates against many other APIs, code bases, etc. that are hard to reproduce (see eg some forms of crypto custody such as Anchorage where each codebase and blockchain needs to be audited for security + added

Services does integrations for the company against other vendors. For example, ERP systems like SAP and Netsuite are hard to displace as each implementation is a unique, multi-quarter process to integrate the ERP system with many other vendors inside an enterprise. EMRs such as Epic are another example of integration-driven and long-term contract driven defensibility.

Building a ton of stuff.

Bundling. Bundling and cross selling products prevent other companies from finding a wedge to compete with you, or create better sales success via superior interoperability, pricing, or procurement processes. See Workday, Rippling, Deel or Ashby as examples of companies that early on planned to bundle multiple products usually provided by different vendors.

Big product footprint. For some products, the breadth and depth of the product footprint means it is hard for new entrants to compete, as it takes too much time to reach feature parity before one can sell to customers competitively. This is why many startups first launch to the low end of a market segment, and then build depth of product over time as they move up into enterprise.

Deals. Different types of deals can create defensive moats. This may include:

Early access. Early access to APIs, data or other unique assets may provide a competitive advantage. For example, OpenAI has provided some companies with early access to GPT-4.

Exclusive provider or distribution. Sometimes locking in as an exclusive provider can get scale, brand, or distribution advantages for a company. For example, Google’s early exclusive deals to power search for Yahoo! And AOL were company-making moments. Similarly, Microsoft’s early OS deal with IBM was a king making moment.

Backend. Some markets require hard to get deals in place or ones that take a year to execute and implement. This may include things like payment bank ends or banking access.

Sales as moat. Many SaaS or enterprise companies eventually develop sales driven moats. Moats may include:

Multi year contracts. Long term contracts to lock in customers for multiple years. Some industries have extreme versions of this where customers sign up for 5-7 year deals, so once a market is locked up it is hard for a new entrant to gain any share.

Sales process. Often when selling to a large enterprise you need to go through multiple reviews and functions at the buyer including security review and audit, procurement, IT, and other areas. These reviews can take many months to complete, so it is often easier for enterprises to buy a less-good bundled product from an existing vendor, then a better stand alone product from a new supplier.

Regulatory. Some companies receive regulatory approvals that provide a moat. For example, early on AngelList received a “No Action” letter from the SEC that allowed it to run syndicates.

Data or system of record effect. Having unique or proprietary data, or owning a customers data or having a long historical record of it can create defensibility. Similarly, being a “system of record”, for a user, entity, etc. can be a powerful position to be in. On average, data effects tend to be overstated outside of highly scaled consumer products or very specific verticals.

Scale effects.

Capital scale. Having access to large sums of money sometimes creates the environment to execute quickly and build a network effect or defensible position - this happened with both Uber and TikTok.

Business scale and negotiation. Sometimes pre-negotiating “scaled pricing” allows you to offer a service cheaper than anyone else, creating a self-fulfilling loop. This happened with Intel and early semiconductor releases. Similarly, there are scale effects in payments or other services, where the more volume you have, the cheaper your own backend providers become.

Open source.

Creator advantage. Sometimes the teams that implemented or created an open source software project are best positioned to commercialize said product, given their ability to drive and control contributions to said project + brand and relationships in that community. See e.g. dbt Labs.

Openness. Some dev teams only want to adopt open-source software for specific areas.

Brand. Eventually a brand may be built that positions a company as the default choice for a specific use case.

IP Moat. Intellectual property tends to be more capable of protecting hard tech or biotech companies than most consumer or SaaS products.

Other forms of defensibility. Usually the forms below create the largest advantage when competing with incumbents versus other startups, as other startups may be able to copy said advantages.

Speed. One of the few advantage a startup has against an incumbent is its speed. It definitionally will have fewer people, less money, fewer customers and a smaller product footprint. Speed of iteration and execution, responsiveness to customers request, and speed of hiring and closing candidates are all advantages. Oddly, speed also turns out to be an advantage versus most other startups - few teams can execute at high levels consistently.

Pricing. Occasionally startups may have a pricing advantage relative incumbents (but maybe not other startups) via a lower cost structure, a lack of an existing product to cannibalize, or due to a different business model. In some cases a startup can give something away for free as a wedge to cross sell an incremental product in a way others can not compete. “Your margin is my opportunity” is a famous quote by Jeff Bezos on Amazon and its advantages entering new markets.

New business models. Sometimes a startup can innovate on business model to create a higher leverage business or different incentive structure. For example, Anduril in defensetech has a traditional tech margin-based business, while all the incumbents sell “cost plus” (ie they charge 5-8% on top of what is cost them to build the product for the Department of Defense). The cost plus model creates a lot of incentives to act badly - for example since labor is charged as part of the cost plus, delays and doing things slowly means more revenue for the incumbents. Similarly, the reason some items have $100 screws is so they can charge 5% on top of it (instead of just using a 10 cent screw).

Most of the forms of defensibility above take a few years to build.

Why aren’t there more fast follows?

Given that most startups take time to build defensibility, this raise the question of why more startup founders don’t just copy companies that are already working, but early in their journey?

Reasons may include:

1. It is sometimes hard to know what is actually working, versus hype.

2. Founders have a lot of pride in what they build, and may not want to just copy and out-execute someone. Often when a startup copies another’s idea, they put a unique spin on that approach or product versus default blankly copying it. All these tweaks and changes tend to make the product worse.

3. Perception that “the market is over” so no one copies a company even if it might be tractable to out execute them.

4. It is harder to hire strong employees to work on what is initially a clone company. People assume more defensibility than tends to exist early, so are harder to convince to join your efforts until traction is clear.

Startups & incumbents - evolution of competition

Most good startup ideas are definitionally non-obvious (otherwise everyone would be doing them). Often, good startup ideas seem small, niche, or toy like. Only desperate people will go and build in these areas as they may seem too small a market or use case initially to large incumbents.

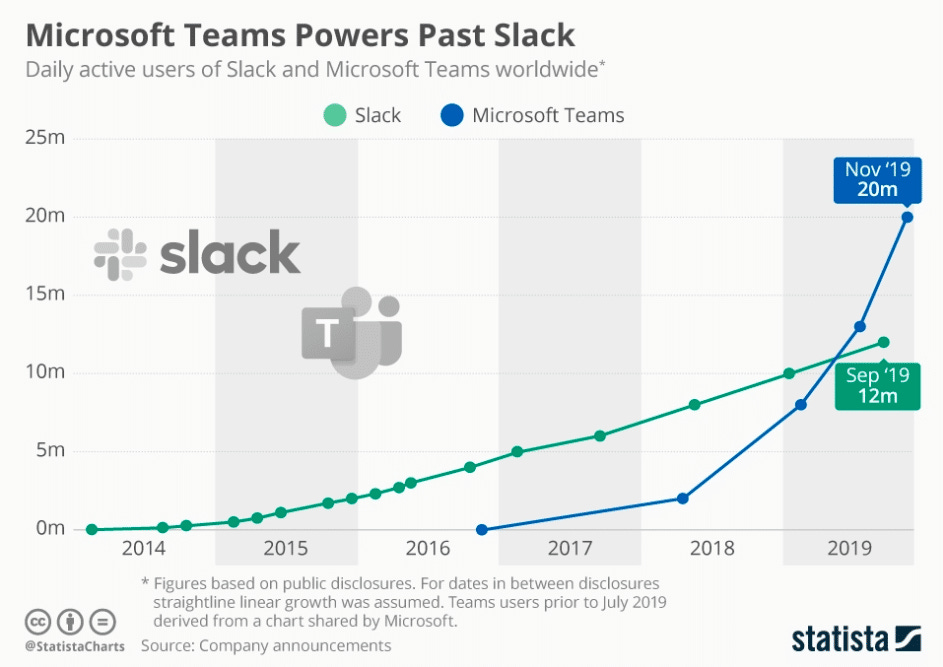

Often in the first 4-5 years of a successful startup’s life, its main competition is other startups. After a company starts to break away from the startup pack, and proves a large market, that is when a big company tends to remobilize and steer into the direction of a startup. This is often done via cross-bundling and cross-selling - for example Microsoft Teams was successful versus Slack as Microsoft bundled and cross sold Teams to its existing enterprise customer base. This allowed it to gain rapid share. Usually this transition from startup competition to incumbent competition takes between 4-7 years. Incumbent market entrants can either be extremely fierce (see Microsoft Teams) or a bit of an afterthought (see Microsoft Bing versus Google, or Google Plus versus Facebook).

In other circumstances, an incumbent may be aware of a large and obvious opportunity and steer into it much faster - we are seeing this happen now in multiple areas of generative AI where incumbents like Microsoft, Github, Notion, and Intercom are amongst the first to act. Similarly, Meta and its sub products Instagram quickly copied SnapChat stories, curtailing its international growth substantially. Fast market entry or expansion by an incumbent can at times be the death knell for a startup, especially if done early (i.e. the first 1-3 years of startup life).

As a proto-founder, it is worth thinking through how aggressive the incumbents are for your potential product area, how clear they are on the opportunity you are going after, and how likely they are to act. You can often find this out simply by meeting current executives at the company, or asking former employees. Earnings call transcripts can also be revealing at times, as can prior bias to action and ability to ship by an incumbent.

Focus: Navel-Gazing-Centric vs Competition-Centric vs User-Centric

There are roughly three forms of focus for a company. Some large incumbents become so focused gazing at their own navels (or, relatedly their regulators’ navels) that they forget about users and start to create competitive openings for others to exploit. These large companies often have process after process and approval after approval on how to launch, how safe and “equitable” a product is, how to set goals and OKRs, performance reviews, executive reviews, legal reviews, marketing reviews, PR reviews, pre-review meeting reviews, how to map across every single geography at once, etc that they never launch anything that good anymore (or perhaps, launch at all). If you see a company that has not launched anything new in a while, they are probably doing the above.

Another form of company focus is competitor-centric focus. These companies continuously copy what their competitors are doing or have announced, versus what users are actually asking for or want. These companies are externally focused (which is good) but not customer focused (which is frequently bad), and often forget they exist to serve their customers. Sometimes these customers win in a market via lobbying or regulation, but often they end up derivative or staid. Some incumbents may succeed via this strategy - they just copy competitors or buy and bundle them, and keep relevance and market position via that motion.

There is an odd form of competition-centrism with a subset of early stage founders - where all the founder talks about is their competitors - often in a bitter tone about how X company is getting too much press and is raising money too easily and they do not deserve it - and maybe they too should go and do a giant unneeded funding round. For some reason, most bitter founder companies tend to fail.

Finally, there is user centric focus. User-centric companies tend to have a better understanding of their customer and their ongoing needs leading to superior product, sales, customer success, and pricing approaches. By aligning against the customer, more things tend to go right. While being customer-centric helps enormously in most cases, occasionally an incumbent is just too dominant for a superior customer experience and product to win.

What does this all mean for the “wrapper on OpenAI”?

The takeaway is that serving a customer need well is often more important (and harder) to think about than defensibility. In many cases defensibility emerges over time - particularly if you build out a proprietary data set or become an ingrained workflow, or create defensibility via sales or other moats.

The less building and expansion of the product you do after launch, the more vulnerable you will be to other startups or incumbents eventually coming after and commoditizing you. Pace of execution and ongoing shipping post v1 matters a lot to building one forms of defensibility above. Obviously, if your company is defensible up-front it is better then if it isn’t.

Beware the fast-acting incumbent[2] with the easy to add product space that is an obvious and necessary extension of what they are already doing.

NOTES

[1] Examples where things are less clonable includes areas that have deal or licensing moats (e.g. it takes a year to get a banking deal or a broker/deal license), IP (this is stronger in biotech where IP protection matters more), pre-existing open source software that is being commercialized by the team who created it, or other areas.

[2] In general founder-led companies will be more aggressive then non-founder led ones, although Nadella at Microsoft is an impressive counter example of this. Looking at a past history of bias to action (or not) is often revealing as well.

MY BOOK

You can order the High Growth Handbook here. Or read it online for free.

OTHER POSTS

Firesides & Podcasts

Markets:

AI Platforms, Markets, and Open Source

Changing times (or, why is every layoff 10-15%?)

AI Revolution - Transformers and Large Language Models

False Narrative Around Theranos

Industry Towns: Where you start a company matters

Defensibility and Lock-In: Uber and Lyft

Who Cares If Its Been Tried Before?

Startup life

Co-Founders

Raising Money

Founders Should Divide And Conquer

How To Choose The Right VC For You

Signs a VC Just Isn't That Into You

How To Raise A Successful VC Round

Differences Between Funding Rounds: Series Seed, A, B, C...

Financing Approaches Most Likely To Kill Your Company

Party Rounds: How to Get A High Valuation For Your Seed Startup

20 Questions To Ask Yourself Before Raising Money

The 7 Types Of Angel Investors

Old Crypto Stuff: